The global fiscal easing cycle has begun, and Trump's global influence has provided a solid foundation for financial regulation relaxation and continued upward trend in the US dollar system.

Crypto Market Secondary Fund Metrics Ventures July Market Observation Guide

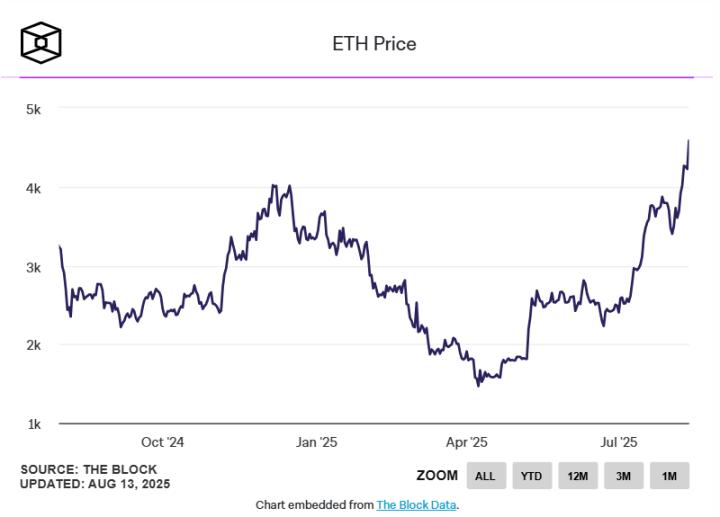

1/ Following our view since May, the continued return of market risk preference has driven the continuous rise of price centers. ETH has significantly outperformed, becoming the hottest topic in the current market, with crypto stocks frequently emerging and trading volume continuously expanding.

2/ For Ethereum, we believe there is no need to overly focus on short-term trends before ETF staking lands, interest rates enter the medium term, and panic buying occurs. Short-term speculative hotspots of funds will always shift, and our view on ETH remains unchanged.

3/ Bitcoin faced billions of dollars in new selling pressure in July. However, under this rigid selling pressure, the asset's intrinsic volatility was still less than 10%, with chips firmly locked around $120,000, which is astonishing. Such selling pressure, besides proving the asset's properties, will only change the final cycle's graph and structure, not the bull or bear fact, and we remain very optimistic about the future market.

4/ The global fiscal easing cycle has begun, and Trump's global influence has provided a solid foundation for financial regulation relaxation and continued upward trend in the US dollar system. Ride the wave, stay focused, and quietly await the moment of divergence during the buying frenzy.

Market Overall Situation and Trend Review

In the past month, the entire US dollar market returned to the familiar low-volatility upward trend of recent years. Momentum typically focused on event-driven targets, with even weak sector linkage. However, Meta and ETH's trends signaled unusual optimism and aggression, worthy of attention. In previous monthly reports, we repeatedly suggested that Q3-Q4 trends would be driven by risk preference return and interest rate cut expectations. Now, these two factors have reached the middle-to-late stages, and we have observed:

①Under the background of global leadership, global submission except for major powers and domestic consistency, including the Federal Reserve;

②US dollar institutions' unsparing position replenishment and continued return of US dollar exceptionalism;

③Financial regulation relaxation continuously promoted by ongoing legislation, financial chaining, and leverage rate relaxation;

Overall, we believe monetary easing in price gaming has at most reached the midpoint, but expected gaming will enter an extremely involution period. Therefore, short-term gaming of short-line data and technical graphs will be a continuously negative EV strategy. Price rotation is healthy, and trading volume expansion becomes a neutral event requiring careful analysis.

As for the RMB market, last year's analysis is slowly gaining recognition. At present, technology (chips, AI, etc.) and inflation (chemical, non-ferrous metals) are the best subdivisions in MVC's view, and investment advice is welcome.

The market fluctuates, momentum comes and goes, causing people's hearts to float. Old crypto chips are gradually lost in this process. We hope that everyone can find the next stage's top of the US dollar cycle in the upcoming period. Ride the Wave and Have fun.