Author: Liu Ye Jinghong

Original link: https://mp.weixin.qq.com/s/y5WED5zyPPRB-WPS2QOKkg

Disclaimer: This article is a reprint. Readers can find more information by following the original link. If the author has any objections to the reprint format, please contact us and we will modify it to suit the author's request. This reprint is for informational purposes only and does not constitute investment advice or represent the views or positions of Wu Blockchain.

introduction

I've recently been deeply involved in several real-world asset (RWA) tokenization projects, conducting in-depth research on these businesses. To facilitate understanding, this article will share some of our core observations and reflections in the form of a FAQ.

Q1: Why is RWA so popular recently?

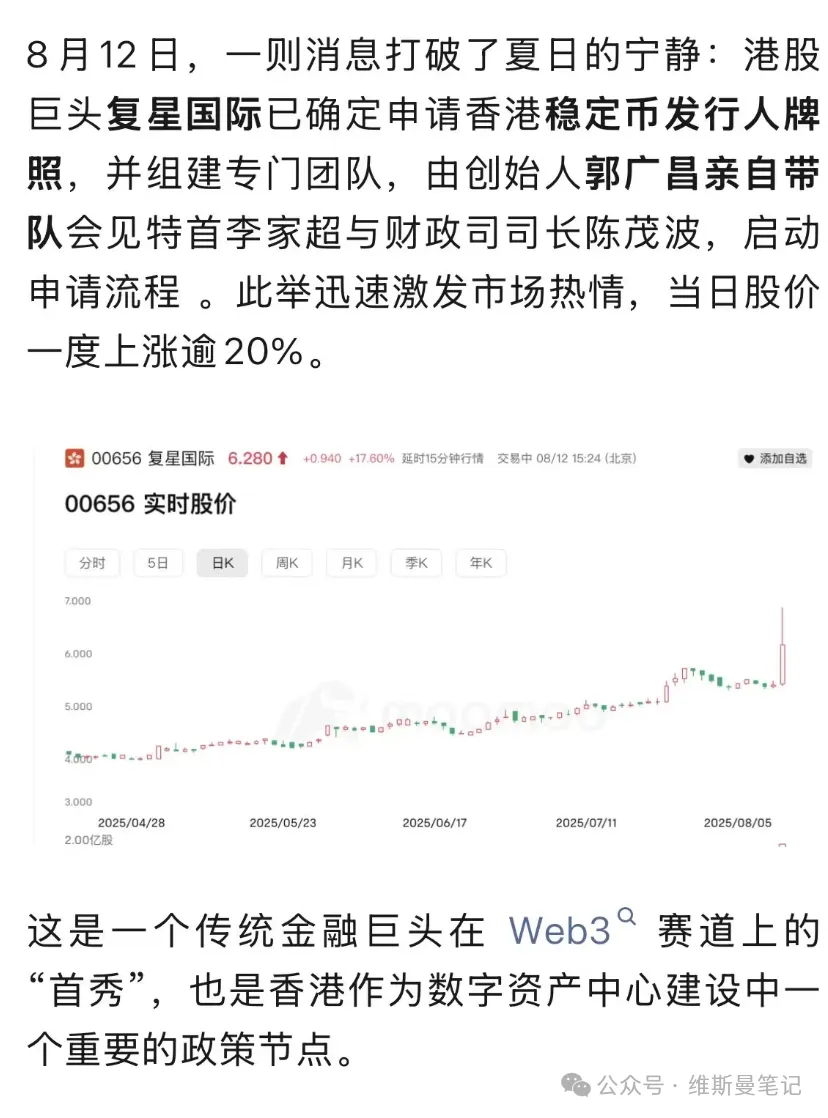

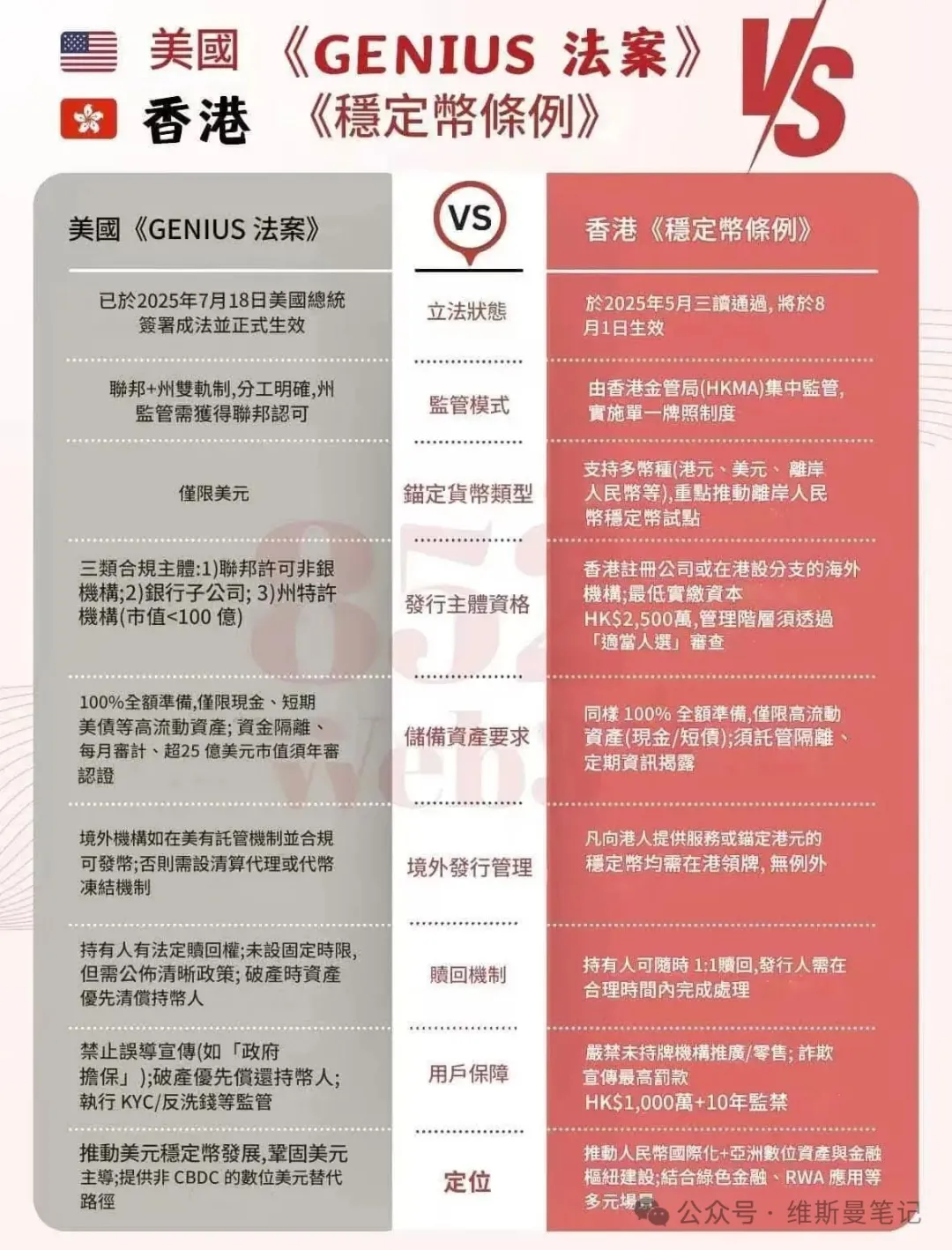

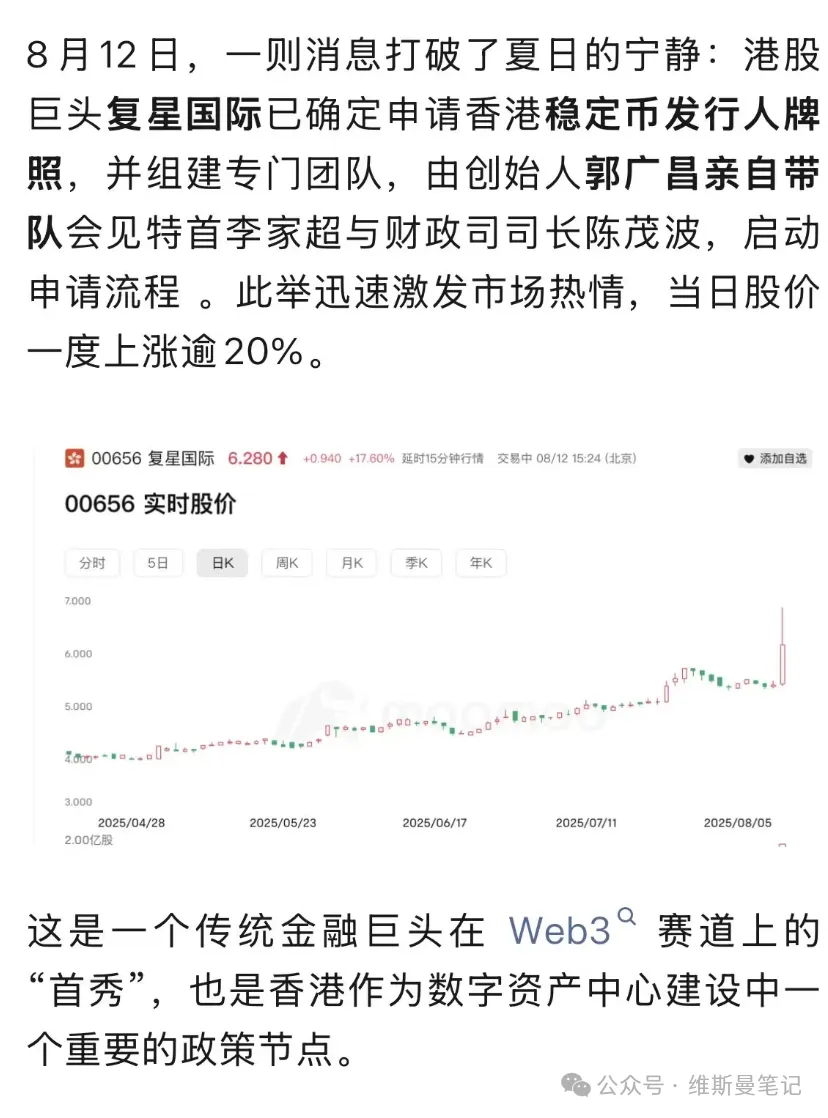

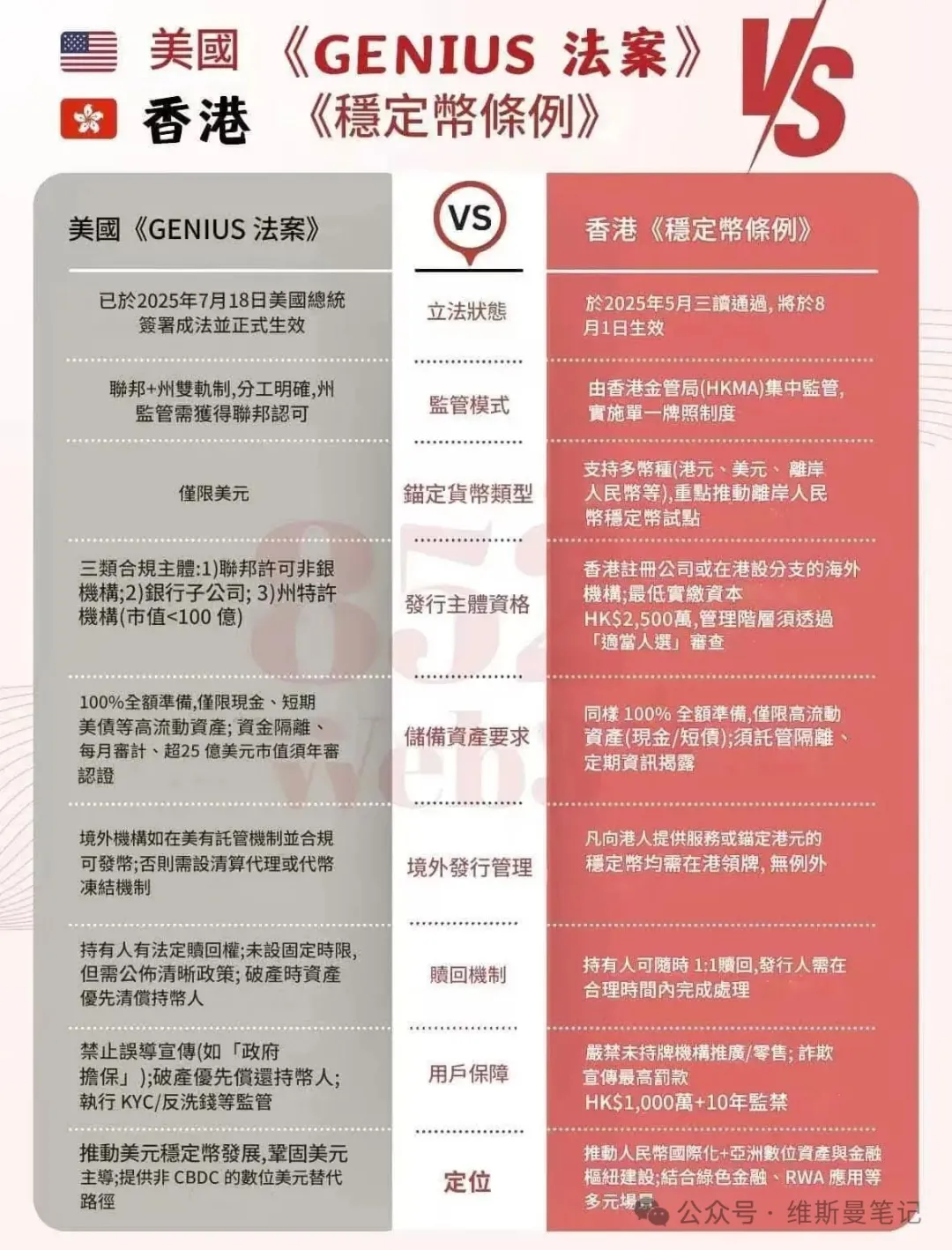

The fundamental reason for the RWA boom is the official entry into force of Hong Kong's Stablecoin Ordinance on August 1, 2025. This marks the full compliance of stablecoins as anchor currencies for transaction settlement. With the Hong Kong government's strong support for the compliant issuance of virtual assets, a legally sound and compliant virtual asset market framework has taken shape.

From a market perspective, many companies hope that Hong Kong's RWAs will open up a new, compliant financing channel, and some listed companies also hope to boost market confidence and stock prices by entering this market. This expectation is similar to some of the market sentiment during the early ICO boom.

Q2: Is there any difference between Hong Kong RWA and Web3 RWA?

The difference is so huge that the two don't even have a direct business connection.

The core of Hong Kong's RWA is "full-chain compliance." The underlying assets must meet the legal requirements of both jurisdictions: compliance in the asset's location (e.g., mainland China) and local compliance in Hong Kong. This compliance requirement goes far beyond the technical level of "consortium blockchain ownership confirmation" and must be based on clear, legally binding documentation and approvals. For example, data assets must complete compliant cross-border registration, while physical assets must undergo compliant cross-border transfer procedures.

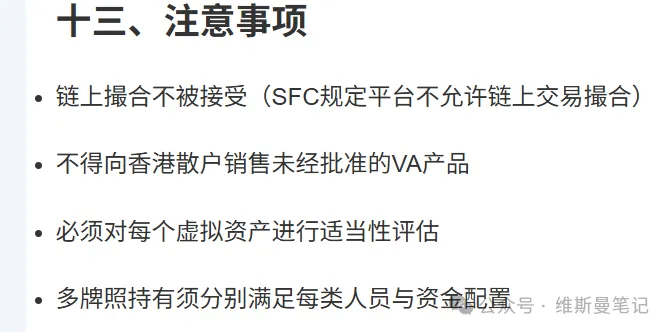

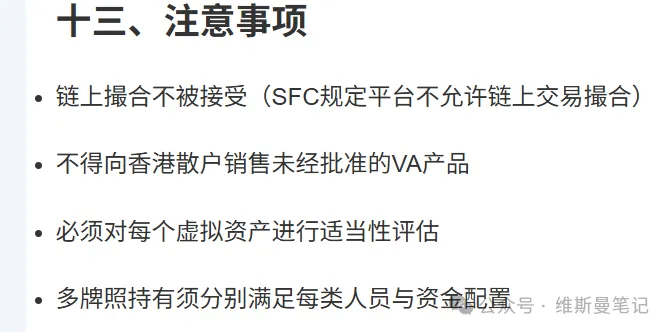

A common market concept is to, for example, confirm the ownership of mainland real estate on-chain and then issue RWAs in Hong Kong. However, this approach is completely unfeasible under the current framework. First, the Hong Kong Securities and Futures Commission (SFC) explicitly prohibits automated on-chain matching transactions. Second, the complete transfer of mainland real estate ownership to Hong Kong faces significant legal and practical obstacles.

Currently, the forms of RWAs officially encouraged by the Hong Kong Monetary Authority (HKMA) are primarily stablecoins and tokenized bonds (such as government-issued green bonds). While the operational model for a broader range of physical RWAs remains unclear, it is clear that regulators do not accept issuance solely based on blockchain-based title confirmation. Assets must be fully regulated within Hong Kong's regulatory framework.

Therefore, in the application of blockchain technology, Hong Kong RWA emphasizes its nature as a "regulated distributed ledger" rather than the global free trade and circulation pursued by Web3 RWA.

Q3: How to understand Hong Kong RWA in a simple way?

At the current stage, Hong Kong RWA can be understood as a "futures market that allows private compliant issuance."

Just as crude oil futures require designated storage locations for the holding and delivery of physical crude oil, Hong Kong RWAs also require that their underlying assets be effectively regulated by Hong Kong's financial regulators. If the underlying physical assets of an RWA cannot be regulated, it is highly unlikely to be approved. For example, converting rental income from non-Hong Kong properties into RWAs is highly unlikely to be approved, as neither the properties themselves nor the lease agreements are directly regulated in Hong Kong.

In contrast, some intangible assets, such as entertainment copyrights, have a greater potential for RWA issuance. As long as the ownership of such assets is clear and compliant under mainland Chinese law, and the rights and interests can be legally transferred to a Hong Kong regulatory entity, their future earnings may be used to issue RWAs.

It's worth noting that the Hong Kong government currently doesn't require the underlying assets of RWAs to be located in Hong Kong. The key requirement is that the assets be "regulated by the Hong Kong government." Based on this, I predict that even if a high-quality asset is not located in Hong Kong, it may be approved for issuance if it can provide a comprehensive set of credible evidence that meets Hong Kong regulatory requirements (for example, ongoing audit reports from a "Big Four" accounting firm).

Q4: Can RWA be traded after it is issued?

No. Issuing RWA and trading RWA are two completely separate things.

Issuing RWAs is more like a fundraising activity. Once the issuance application is approved, the issuer can raise funds from "qualified investors." However, this does not mean that the tokens can be publicly traded.

To enable trading, the Hong Kong Securities and Futures Commission (SFC) has set regulatory red lines, prohibiting automated on-chain trading of RWA tokens. The only way to do this is to apply for listing on a licensed virtual asset trading platform (VASP) in Hong Kong.

Furthermore, these regulated virtual asset trading platforms are open only to qualified investors, essentially eliminating the possibility of attracting large numbers of retail investors through community marketing hype. This is a stark contrast to the operating model of some crypto assets, such as Meme Coin. Furthermore, listing on regulated platforms is expected to incur significant fees.

Q5: What about the issuance of compliant stablecoins in Hong Kong?

Among all RWA categories, the feasibility of issuing compliant stablecoins is the greatest, especially stablecoins issued based on high-quality assets such as Hong Kong dollars, offshore RMB, US dollars or high-credit-rating bonds.

Of course, the barrier to entry is also extremely high. Leaving aside the complex compliance process, the capital cost alone presents a significant barrier to entry for most startups. According to the Stablecoin Regulations, issuers must maintain a minimum of HK$25 million in paid-in capital and be subject to centralized oversight by the HKMA. Furthermore, issued stablecoins must be 100% backed by high-quality liquid assets as reserves.

Q6: Can consortium chain technology be used to issue Hong Kong RWA?

This is a common and significant misunderstanding. While the application scenarios of domestic consortium blockchains (such as property rights confirmation and traceability) are completely unrelated to the compliance requirements of Hong Kong's RWA, some business leaders we've encountered often conflate the two.

The legal validity of Hong Kong RWA projects relies entirely on the clarity of ownership and authenticity of the underlying assets. According to analysis by Hong Kong legal experts, issuers must fulfill strict verification obligations, including:

Legal document verification: Confirm that the assets are free of any rights and encumbrances through property registration documents, judicial declarations, etc.

Financial penetration audit: entrust a licensed auditing agency to verify the cash flow and liabilities of assets to prevent financial fraud.

Independent third-party valuation: For non-standard assets, an independent appraisal agency must use multiple models to provide valuation endorsement.

In short, the Hong Kong RWA project only recognizes legally binding written documents and the review results of licensed third-party institutions, and does not accept technical "on-chain title confirmation" as the basis for legal effectiveness.

Q7: What is the purpose of issuing RWA in Hong Kong?

In my opinion, for formal enterprises, its core functions are mainly two: one is to expand new compliant financing channels for high-quality assets; the other is that for listed companies, it can serve as a positive signal to boost market confidence.

However, we must be vigilant. There are many participants in the current market who use RWAs as a speculative narrative. Their true purpose may not be to complete a compliant issuance, but rather to capitalize on this hot concept for private placement financing or market speculation. This phenomenon is not uncommon in the industry and warrants high vigilance from investors and practitioners.

Summarize

In short, Hong Kong RWA is a very new field, with only a handful of successful implementations. Therefore, the perspectives presented in this article may still be limited, and I will continue to update my understanding as I gain a deeper understanding of the business. This article serves only as a record of my personal experience at this point in time, and I hope it will provide valuable reference for those interested in this field.

Original link: https://mp.weixin.qq.com/s/y5WED5zyPPRB-WPS2QOKkg

Disclaimer: This article is a reprint. Readers can find more information by following the original link. If the author has any objections to the reprint format, please contact us and we will modify it to suit the author's request. This reprint is for informational purposes only and does not constitute investment advice or represent the views or positions of Wu Blockchain.

introduction

I've recently been deeply involved in several real-world asset (RWA) tokenization projects, conducting in-depth research on these businesses. To facilitate understanding, this article will share some of our core observations and reflections in the form of a FAQ.

Q1: Why is RWA so popular recently?

The fundamental reason for the RWA boom is the official entry into force of Hong Kong's Stablecoin Ordinance on August 1, 2025. This marks the full compliance of stablecoins as anchor currencies for transaction settlement. With the Hong Kong government's strong support for the compliant issuance of virtual assets, a legally sound and compliant virtual asset market framework has taken shape.

From a market perspective, many companies hope that Hong Kong's RWAs will open up a new, compliant financing channel, and some listed companies also hope to boost market confidence and stock prices by entering this market. This expectation is similar to some of the market sentiment during the early ICO boom.

Q2: Is there any difference between Hong Kong RWA and Web3 RWA?

The difference is so huge that the two don't even have a direct business connection.

The core of Hong Kong's RWA is "full-chain compliance." The underlying assets must meet the legal requirements of both jurisdictions: compliance in the asset's location (e.g., mainland China) and local compliance in Hong Kong. This compliance requirement goes far beyond the technical level of "consortium blockchain ownership confirmation" and must be based on clear, legally binding documentation and approvals. For example, data assets must complete compliant cross-border registration, while physical assets must undergo compliant cross-border transfer procedures.

A common market concept is to, for example, confirm the ownership of mainland real estate on-chain and then issue RWAs in Hong Kong. However, this approach is completely unfeasible under the current framework. First, the Hong Kong Securities and Futures Commission (SFC) explicitly prohibits automated on-chain matching transactions. Second, the complete transfer of mainland real estate ownership to Hong Kong faces significant legal and practical obstacles.

Currently, the forms of RWAs officially encouraged by the Hong Kong Monetary Authority (HKMA) are primarily stablecoins and tokenized bonds (such as government-issued green bonds). While the operational model for a broader range of physical RWAs remains unclear, it is clear that regulators do not accept issuance solely based on blockchain-based title confirmation. Assets must be fully regulated within Hong Kong's regulatory framework.

Therefore, in the application of blockchain technology, Hong Kong RWA emphasizes its nature as a "regulated distributed ledger" rather than the global free trade and circulation pursued by Web3 RWA.

Q3: How to understand Hong Kong RWA in a simple way?

At the current stage, Hong Kong RWA can be understood as a "futures market that allows private compliant issuance."

Just as crude oil futures require designated storage locations for the holding and delivery of physical crude oil, Hong Kong RWAs also require that their underlying assets be effectively regulated by Hong Kong's financial regulators. If the underlying physical assets of an RWA cannot be regulated, it is highly unlikely to be approved. For example, converting rental income from non-Hong Kong properties into RWAs is highly unlikely to be approved, as neither the properties themselves nor the lease agreements are directly regulated in Hong Kong.

In contrast, some intangible assets, such as entertainment copyrights, have a greater potential for RWA issuance. As long as the ownership of such assets is clear and compliant under mainland Chinese law, and the rights and interests can be legally transferred to a Hong Kong regulatory entity, their future earnings may be used to issue RWAs.

It's worth noting that the Hong Kong government currently doesn't require the underlying assets of RWAs to be located in Hong Kong. The key requirement is that the assets be "regulated by the Hong Kong government." Based on this, I predict that even if a high-quality asset is not located in Hong Kong, it may be approved for issuance if it can provide a comprehensive set of credible evidence that meets Hong Kong regulatory requirements (for example, ongoing audit reports from a "Big Four" accounting firm).

Q4: Can RWA be traded after it is issued?

No. Issuing RWA and trading RWA are two completely separate things.

Issuing RWAs is more like a fundraising activity. Once the issuance application is approved, the issuer can raise funds from "qualified investors." However, this does not mean that the tokens can be publicly traded.

To enable trading, the Hong Kong Securities and Futures Commission (SFC) has set regulatory red lines, prohibiting automated on-chain trading of RWA tokens. The only way to do this is to apply for listing on a licensed virtual asset trading platform (VASP) in Hong Kong.

Furthermore, these regulated virtual asset trading platforms are open only to qualified investors, essentially eliminating the possibility of attracting large numbers of retail investors through community marketing hype. This is a stark contrast to the operating model of some crypto assets, such as Meme Coin. Furthermore, listing on regulated platforms is expected to incur significant fees.

Q5: What about the issuance of compliant stablecoins in Hong Kong?

Among all RWA categories, the feasibility of issuing compliant stablecoins is the greatest, especially stablecoins issued based on high-quality assets such as Hong Kong dollars, offshore RMB, US dollars or high-credit-rating bonds.

Of course, the barrier to entry is also extremely high. Leaving aside the complex compliance process, the capital cost alone presents a significant barrier to entry for most startups. According to the Stablecoin Regulations, issuers must maintain a minimum of HK$25 million in paid-in capital and be subject to centralized oversight by the HKMA. Furthermore, issued stablecoins must be 100% backed by high-quality liquid assets as reserves.

Q6: Can consortium chain technology be used to issue Hong Kong RWA?

This is a common and significant misunderstanding. While the application scenarios of domestic consortium blockchains (such as property rights confirmation and traceability) are completely unrelated to the compliance requirements of Hong Kong's RWA, some business leaders we've encountered often conflate the two.

The legal validity of Hong Kong RWA projects relies entirely on the clarity of ownership and authenticity of the underlying assets. According to analysis by Hong Kong legal experts, issuers must fulfill strict verification obligations, including:

Legal document verification: Confirm that the assets are free of any rights and encumbrances through property registration documents, judicial declarations, etc.

Financial penetration audit: entrust a licensed auditing agency to verify the cash flow and liabilities of assets to prevent financial fraud.

Independent third-party valuation: For non-standard assets, an independent appraisal agency must use multiple models to provide valuation endorsement.

In short, the Hong Kong RWA project only recognizes legally binding written documents and the review results of licensed third-party institutions, and does not accept technical "on-chain title confirmation" as the basis for legal effectiveness.

Q7: What is the purpose of issuing RWA in Hong Kong?

In my opinion, for formal enterprises, its core functions are mainly two: one is to expand new compliant financing channels for high-quality assets; the other is that for listed companies, it can serve as a positive signal to boost market confidence.

However, we must be vigilant. There are many participants in the current market who use RWAs as a speculative narrative. Their true purpose may not be to complete a compliant issuance, but rather to capitalize on this hot concept for private placement financing or market speculation. This phenomenon is not uncommon in the industry and warrants high vigilance from investors and practitioners.

Summarize

In short, Hong Kong RWA is a very new field, with only a handful of successful implementations. Therefore, the perspectives presented in this article may still be limited, and I will continue to update my understanding as I gain a deeper understanding of the business. This article serves only as a record of my personal experience at this point in time, and I hope it will provide valuable reference for those interested in this field.