The immigration expulsion actions promoted by US President Trump are pushing the economy towards an invisible warning line. Moody's chief economist Mark Zandi warned earlier this week that if the US maintains an average deportation rate of 750 people per day, inflation could approach 4% as early as early 2026, higher than the Federal Reserve's (Fed) target range.

Wall Street investors are therefore worried that the US may replay the "high prices, low growth" situation of the 1970s.

Labor Supply Shrinks, Price Pressure Rises Simultaneously

Zandi explained that immigration expulsion directly squeezes labor supply, causing companies to pay higher wages to compete for workers, ultimately raising production and service costs. He pointed out:

The labor force of foreign-born workers is declining, and the overall labor force has remained stable since the beginning of the year.

Cost pressures are now slowly reflecting in inflation data, such as the July Producer Price Index (PPI) released by the US Department of Labor this Thursday, which was significantly higher than expected, with service costs accounting for three-quarters of the increase, and fresh and dried vegetable prices jumping nearly 40%.

Federal Reserve at a Crossroads, Interest Rate Hikes Struggle to Resolve Labor Shortage

The current inflation is a typical supply-side shock, and the Fed's traditional tools seem inadequate. Zandi emphasized: "Lowering interest rates will not bring more immigrants to the country." If the Fed raises interest rates to control prices, increased borrowing costs may suppress investment and consumption, exacerbating economic slowdown.

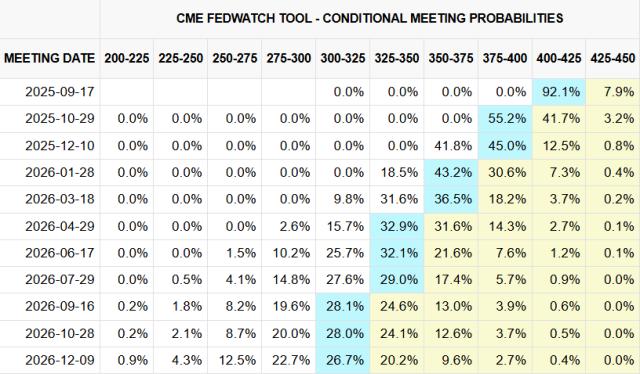

Conversely, if they remain inactive, inflation could spiral out of control. This dilemma adds more uncertainty to the Fed's decision-making.

Policy Choices, Testing US Economic Long-Term Momentum

Immigrants have long supported US technology R&D, agriculture, and construction industries. If supply is long-term limited, not only will prices rise, but innovation and production potential may also be hollowed out. The Trump administration adhered to the political appeal of "America First," but when politics override economic calculations, balancing labor force and prices becomes more difficult.

Moving forward, Washington must find a balanced approach between protecting domestic workers and maintaining economic vitality, otherwise the dual pressures of inflation and growth may become a lingering cloud in the coming years.

Currently, the market awaits the Fed's September meeting for direction; in the long run, if immigration policy lacks a "rational turn," Zandi's estimated 4% inflation may just be the beginning. This tug-of-war between labor and prices is determining the direction of the next US economic cycle.