Cryptocurrency Market Performance

Currently, the total cryptocurrency market value is $4.04 trillion, with BTC accounting for 58.63%, which is $2.36 trillion. The stablecoin market value is $273.4 billion, with a 7-day increase of 1.39%, of which USDT accounts for 60.43%.

Among the top 200 projects on CoinMarketCap, most are rising with a few declining, including: OKB with a 7-day increase of 111.49%, AERO with a 7-day increase of 63.84%, RAY with a 7-day increase of 30.44%, SKL with a 7-day increase of 109.68%, USELESS with a 7-day increase of 52.53%.

This week, the net inflow of US Bitcoin spot ETF is $547.7 million; the net inflow of US Ethereum spot ETF is $2.852 billion.

Market Forecast (August 18-August 22):

This week, stablecoins have significant new issuance, with continuous net inflows of US Bitcoin and Ethereum spot ETFs, and Altcoins showing significant gains. The RSI index is 44.15, indicating overbought conditions. The Fear and Greed Index is 59 (lower than last week).

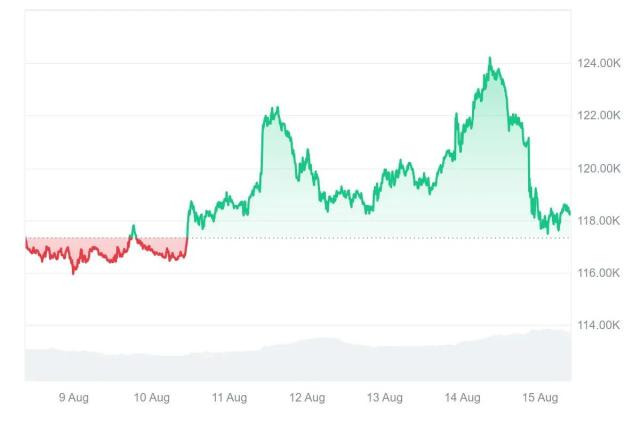

BTC: After breaking through $123,218, looking to $125,000; if the Federal Reserve takes a hawkish stance, BTC may retrace, with support at $112,000;

ETH: With continuous purchases by listed companies, ETH is expected to challenge $5,000, with support at $4,400;

Short-term traders should focus on key resistance/support levels, while long-term investors should use retracements for positioning and pay attention to the September interest rate decision and Bitcoin halving cycle window.

Understanding Now

Weekly Major Events Review

1. On August 12, according to Jupiter data, in the Solana token issuance platform market share ranking in the past 24 hours, pump.fun ranked first with 69.7%, Letsbonk ranked second with 15.2%, and BAGS ranked third with 9.14%;

2. On August 12, Ethereum reserves on CEX dropped to the lowest level since July 2016, declining 6.7% in Q3 so far this year;

3. On August 12, billionaire Peter Thiel invested in Ethereum again. According to the latest SEC filing, Peter Thiel and his investment team acquired 7.5% of ETHZilla's (formerly 180 Life Sciences Corp.) shares;

4. On August 13, according to 8Marketcap data, as ETH briefly broke through $4,600, ETH's market value was temporarily reported at $556 billion, surpassing Netflix to rank 25th in global asset market value;

5. On August 13, Bitmine Immersion (BMNR) announced plans to increase financing by $20 billion to acquire more ETH;

6. On August 12, Aave announced active loan amount exceeded $25 billion, a historical high;

7. On August 14, according to rockflow data, the crypto trading platform Bullish (BLSH) rose 83.78% on its first day of US stock listing, closing at $68, with a market value of $9.94 billion, trading volume of $5.176 billion, and a turnover rate of 185.45%;

8. On August 14, Bitcoin briefly broke through $124,000, continuing to create a new high, reaching a peak of $124,051, currently priced at $123,930, with a 24-hour increase of 3.29%;

9. On August 14, US Treasury Secretary Becent stated that (regarding cryptocurrency reserves) he will not purchase but will use confiscated assets.

Macroeconomic Situation

1. On August 12, the US July unadjusted core CPI year-on-year rate further rose to 3.1%, a five-month high, higher than the market expectation of 3.0%, previous value 2.90%;

2. On August 12, the US July unadjusted CPI year-on-year rate was 2.7%, expected 2.80%, previous value 2.70%. Remained flat from the previous month, slightly lower than expected;

3. On August 14, after the US July PPI data was released, the probability of the Federal Reserve cutting rates by 25 basis points in September slightly decreased to 92.5%, with a 7.5% probability of maintaining current rates;

4. On August 14, US initial jobless claims for the week ending August 9 were 224,000, expected 228,000, previous value revised from 226,000 to 227,000.

ETF

According to statistics, from August 11 to August 15, the US Bitcoin spot ETF net inflow was $547.7 million; as of August 15, GBTC (Grayscale) has a total outflow of $23.758 billion, currently holding $23.151 billion, IBIT (BlackRock) currently holds $88.6 billion. The total market value of US Bitcoin spot ETFs is $153.043 billion.

The US Ethereum spot ETF net inflow is $2.852 billion.

Foreseeing the Future

Event Announcements

1. Coinfest Asia 2025 will be held from August 21 to 22 in Bali, Indonesia;

2. WebX Asia 2025 will be held from August 25 to 26 in Tokyo, Japan;

3. Bitcoin Asia 2025 will be held from August 28 to 29 at the Hong Kong Convention and Exhibition Centre.

Important Events

1. August 20, 10:00, New Zealand Central Bank to announce interest rate decision;

2. August 21, 20:30, US to release initial jobless claims for the week ending August 16 (in thousands);

3. August 22, 22:00, Federal Reserve Chairman Powell to speak at the Jackson Hole Global Central Bank Annual Conference.

Token Unlocks

1. ZKsync (ZK) will unlock 172 million tokens on August 17, valued at approximately $11.22 million, accounting for 3.61% of circulating supply;

2. Fasttoken (FTN) will unlock 20 million tokens on August 18, valued at approximately $91.4 million, accounting for 2.08% of circulating supply;

3. LayerZero (ZRO) will unlock 25.72 million tokens on August 20, valued at approximately $55.53 million, accounting for 8.53% of circulating supply;

4. KAITO (KAITO) will unlock 23.35 million tokens on August 20, valued at approximately $25.22 million, accounting for 8.82% of circulating supply.

About Us

Hotcoin Research, as the core research and investment institution of Hotcoin Exchange, is committed to transforming professional analysis into your practical tool. Through our 'Weekly Insights' and 'In-depth Reports', we dissect market context for you; using our exclusive column 'Hotcoin Strict Selection' (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Every week, our researchers will also interact with you through live broadcasts to interpret hot topics and predict trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investment inherently carries risks. We strongly recommend that investors fully understand these risks and invest only within a strict risk management framework to ensure capital safety.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com