Circle and Stripe, along with many startups, are developing their own Layer 1 blockchain to increase control and integration strategy in the cryptocurrency ecosystem.

Owning a platform blockchain helps stablecoin issuers accelerate payment speed, improve interoperability, and comply with regulations more effectively, minimizing risks of dependence on external ecosystems.

- Large companies like Circle, Stripe, and startups are developing their own blockchain for stablecoins.

- Control and strategy are the main reasons for building their own Layer 1.

- Owning a platform blockchain helps legal compliance integration, accelerates payments, and reduces dependency risks.

Why are Circle, Stripe, and many startups choosing to build their own blockchain?

Martín Burgherr, Customer Director at crypto bank Sygnum, affirms: Building Layer 1 is a way for businesses to directly control and strategically position themselves in the cryptocurrency ecosystem.

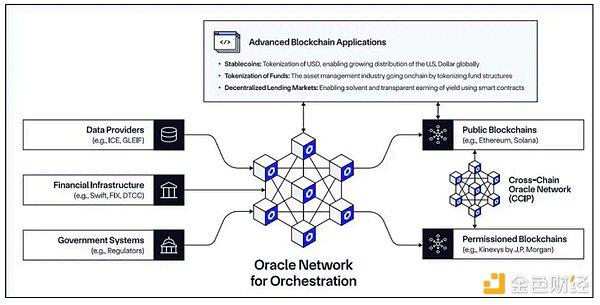

Mr. Burgherr analyzes that the stablecoin economy heavily depends on payment speed, interoperability, and regulatory compliance. Therefore, owning a proprietary platform chain helps more effectively integrate these factors, from embedding compliance tools to direct foreign exchange mechanisms on the blockchain.

Currently, stablecoin issuers still depend on Ethereum, Tron, or other stablecoins for payments. This brings risks related to external fee markets, changes in protocol governance, and technical bottlenecks.

Which startups and blockchain projects are developing their own chains for stablecoins and digital assets?

As of August 17, startups Plasma and Stable have also raised capital to develop a dedicated blockchain for USDT. Meanwhile, Securitize is collaborating with Ethena to build Converge, and Ondo Finance announced plans to launch an internal chain from the beginning of the year.

Additionally, Dinari is developing a Layer 1 network based on Avalanche to support payments and resolve tokenized stock transactions, expanding the potential and applications of specialized blockchain.

"Owning a Layer 1 chain allows companies to directly integrate compliance tools and ensure stable transaction fees, which is a crucial factor in the stablecoin economy."

Martin Burgherr, Chief Client Officer, Sygnum, 2024

What are the benefits of owning a proprietary platform blockchain for stablecoins?

Owning a private blockchain helps stablecoin issuers be proactive in controlling transactions, from processing speed to costs and regulatory compliance. This creates a competitive advantage compared to depending on platforms like Ethereum or Tron.

Moreover, building a proprietary Layer 1 helps stabilize transaction costs and minimize risks from third-party blockchain governance decisions, contributing to improved user experience and trust in the DeFi ecosystem.

Frequently Asked Questions

Why do companies need their own blockchain instead of using Ethereum or Tron?

A private blockchain allows direct control of the payment process, legal compliance integration, and reduces risks of dependence on technical factors, costs, or governance from third-party platforms.

What type of blockchain are Circle and Stripe developing?

Circle and Stripe are developing their own Layer 1 blockchain to increase payment efficiency and integrate compliance mechanisms for stablecoins.

Which startups are prominent in building blockchain for stablecoins?

Plasma, Stable, Securitize collaborating with Ethena, Ondo Finance, and Dinari are pioneering the development of specialized blockchain for stablecoins and tokenized assets.

What is the most important benefit of owning a platform blockchain?

Proactively controlling payment speed, interoperability, transaction costs, and legal compliance, thereby enhancing operational efficiency and reliability.

Does building a private blockchain help reduce transaction costs?

Yes, by directly controlling transaction fees and avoiding fluctuations from external fee markets of third-party blockchains.