A recent survey by Bank of America (BofA) of global fund managers shows that institutional investors are still largely absent from cryptocurrency discussions.

BofA's survey, which polled 211 managers overseeing $504 billion in assets, indicates that cryptocurrency allocation remains more symbolic than strategic.

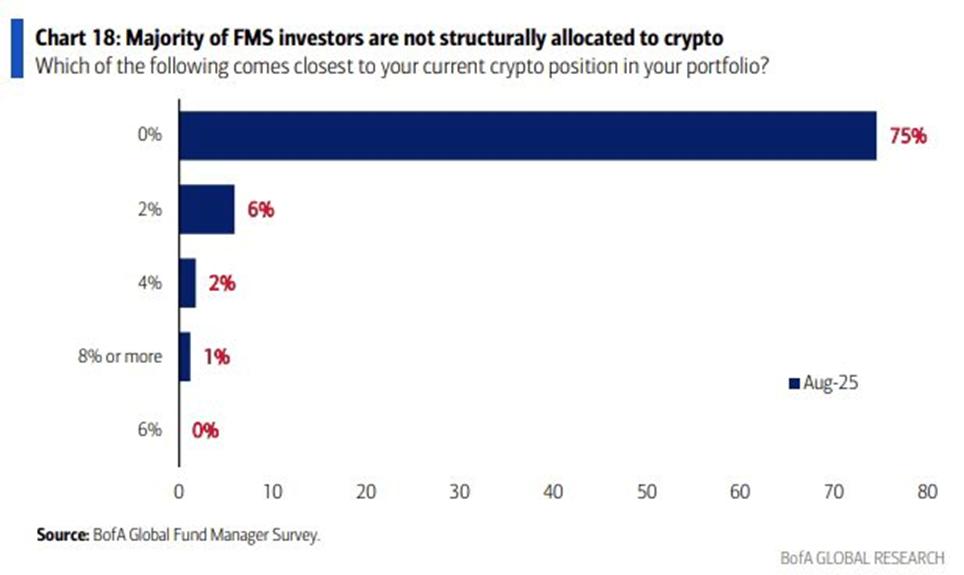

Bank of America Survey: 97% of Big Money Still Avoids Crypto

According to the August survey, most fund managers reported no exposure to cryptocurrencies. Among the few holding digital assets, the Medium allocation was only 3.2% of their investment portfolio.

The Medium allocation dropped to just 0.3% when calculated across the entire survey group.

Large investors holding cryptocurrencies. Source: BofA Survey

Large investors holding cryptocurrencies. Source: BofA SurveyAccording to ETF analyst Eric Balchunas, participants, mainly institutional investors with minimal cryptocurrency exposure (75% at 0% and Medium 3.2% allocation), may lack long-term vision.

His comment stems from their mistaken assessment of selling US assets in Q1 2025, a period when the US market subsequently strongly recovered.

"Aren't these 'global managers' who said they were selling the US in Q1?" Balchunas commented.

Institutional hesitation occurs even as cryptocurrency acceptance gradually becomes more common in mainstream finance. Earlier this month, new 401(k) packages added Bitcoin to retirement investment portfolios in the US.

Despite such developments, BofA found only 9% of fund managers have allocated structure to cryptocurrencies, reflecting Wall Street's caution.

Conversely, stock sentiment significantly improved in the August survey. 14% of portfolio managers increased global stock weightings, compared to only 2% the previous month.

Allocation to global emerging markets increased to its highest level since early 2023. Meanwhile, US stocks remain underweighted due to concerns about overvaluation.

Should Macro Caution Shape Investment Portfolios?

Beyond cryptocurrencies, the survey shows widespread caution among institutional investors. 41% of participants predict weaker global growth in the coming year, up from 31% in July.

Inflation concerns also rose, with 18% forecasting stronger price pressures compared to 6% the previous month.

Cash levels remained stable at 3.9%, just below the 4.0% BofA previously warned was a "sell signal" for US stocks. Such signals led to an average 2% S&P 500 decline over four weeks.

The survey also identified the largest perceived risks. These include the risk of a new global recession due to trade wars (29%), inflation disrupting Federal Reserve rate cuts (27%), and disorderly bond yield increases (20%).

While stocks and bonds remain traditional focus areas, cryptocurrencies remain on the edge of institutional portfolios.

With Wall Street seemingly comfortable staying on the sidelines, experts suggest cryptocurrencies are gradually surpassing traditional markets.

According to Balchunas, fund managers may soon need to reconsider their 3.2%.