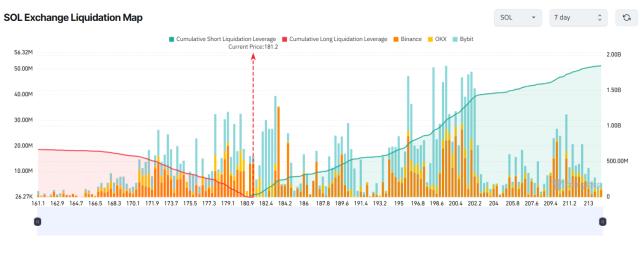

On August 18, according to HTX market information, LINK has risen over 50% in the past two weeks, currently priced at $25.1.

Chainlink launched the "LINK Reserve Fund Plan" in early August, converting on-chain oracle network income and off-chain enterprise service revenue into LINK token reserves at a certain ratio. The reserve scale has currently exceeded $1 million, and in the long term, it will form a supply impact through continuous buyback mechanisms, enhancing the token's value capture ability.

Additionally, according to on-chain data, four addresses have accumulated 580,995 LINK tokens worth $13.86 million in the past 24 hours. Among them, the address "0x4EB" has accumulated a total of 721,294 LINK tokens (worth $16.43 million). The number of large LINK transactions has reached a seven-month high, indicating increased confidence from major investors.

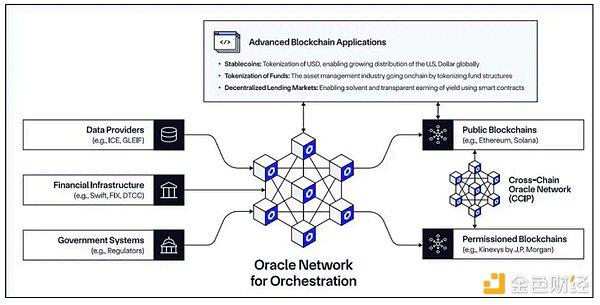

Previously, on August 11, Chainlink partnered with Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, to introduce foreign exchange and precious metal pricing data into the blockchain network. This collaboration will integrate ICE's "Global Comprehensive Data Source" into Chainlink's "Data Streams Service".