Hong Kong Releases New Guidelines Requiring VATPs to Strengthen Cold Wallet Measures and Real-Time Cybersecurity Monitoring.

The Hong Kong Securities and Futures Commission (SFC) has issued new guidelines requiring licensed crypto asset exchanges to enhance customer asset custody measures. This move is part of the region's digital asset infrastructure development roadmap, aimed at addressing increasingly global security risks.

In the Friday statement, the SFC noted that licensed Virtual Asset Trading Platforms (VATPs) need to seriously review custody measures, following multiple international incidents revealing security vulnerabilities and causing significant customer losses. The SFC's targeted review earlier this year also discovered some cybersecurity control deficiencies in VATPs, highlighting an urgent need for stricter standards.

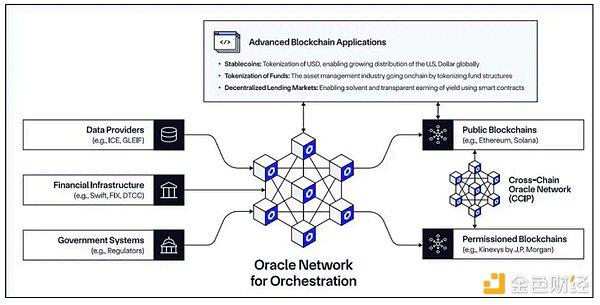

The SFC detailed new expectations in a separate circular, including senior management responsibilities, cold wallet infrastructure, third-party wallet monitoring mechanisms, and real-time cybersecurity threat monitoring. The agency emphasized that these standards will also become core requirements for virtual asset custody entities, contributing to establishing industry-wide common standards.

Notably, the requirements in the circular take effect immediately, demonstrating the urgency of enhancing security standards. Alessio Quaglini, co-founder of Hong Kong-based crypto asset custody company Hex Trust, told The Block that this will likely focus the market on operators with the scale and expertise to meet requirements, making advanced custody solutions more feasible.

Security Risk Context and Policy Differentiation

The SFC's move follows a wave of serious crypto asset security incidents in July, with PeckShield estimating damages from hacks at $142 million, a 27% increase from June. These figures underscore the importance of strengthening customer asset protection measures amid increasingly sophisticated cyber attacks.

This decision also reflects a clear policy differentiation in crypto assets between Hong Kong and mainland China. While mainland China continues to maintain bans on crypto trading and mining, Hong Kong is taking the opposite approach, actively attracting crypto businesses through exchange licensing frameworks.

Additionally, a specific licensing regime for stablecoin issuers officially took effect on August 1st, demonstrating Hong Kong's strong commitment to developing a comprehensive digital asset ecosystem.