The US Treasury Opens Public Consultation on Digital Identity in DeFi Smart Contracts under the GENIUS Act to More Effectively Combat Illegal Finance.

The US Treasury is examining the possibility of integrating digital identity verification measures into DeFi smart contracts as part of a public consultation process under the GENIUS Act for compliance tools in the crypto asset field. This move aims to enhance the ability to combat illegal finance in the rapidly developing decentralized financial ecosystem.

This week, the Treasury published a consultation seeking public opinion on how digital identity tools and new technologies could be applied to combat illegal finance in the crypto market. One proposal is to directly integrate digital identification information into the source code of DeFi protocols.

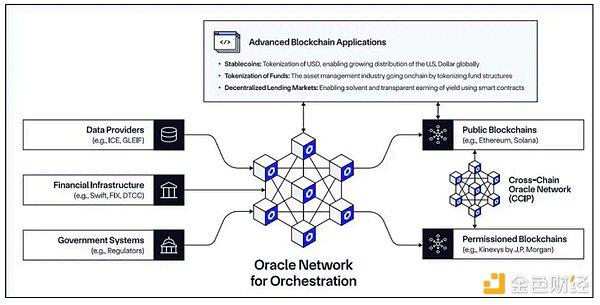

Under this model, smart contracts could automatically verify user identification information before transactions are executed, thereby building in Know Your Customer (KYC) and Anti-Money Laundering (AML) mechanisms directly into the blockchain infrastructure. This approach could revolutionize DeFi operations by combining transparency with regulatory compliance.

This consultation stems from the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act), which was signed into law in July. The Act establishes a legal framework for payment stablecoin issuers and tasks the Treasury with researching new compliance technologies, including APIs, artificial intelligence, digital identity verification, and blockchain monitoring.

Benefits and Challenges of Digital ID

According to the Treasury, digital identification solutions – including government credentials, biometrics, or mobile identities – can help reduce compliance costs while enhancing personal data security. These tools can also help financial institutions and DeFi services detect money laundering, terrorist financing, or sanction evasion just before transactions occur.

However, the Treasury also acknowledges potential challenges, including concerns about data privacy and the need to balance technological innovation with legal oversight. The agency emphasizes welcoming any public contributions related to this effort.

The public consultation process will remain open until October 17, 2025. Afterward, the Treasury will submit a report to Congress and may issue guidelines or propose new regulations based on the findings.

Meanwhile, last week, a group of major US banks led by the Bank Policy Institute (BPI) called on Congress to tighten regulations in the GENIUS Act. BPI warned about potential loopholes that could allow stablecoin issuers to circumvent interest payment limits, potentially leading to cash flow risks of up to $6.6 trillion moving away from traditional banks.

These concerns highlight the complexity of balancing innovation and financial stability in developing a legal framework for stablecoins.