BlackRock is increasing its control over the Bitcoin and Ethereum market through ETFs and investments in Strategy, raising concerns about Wall Street's potential takeover of the cryptocurrency market.

BlackRock's significant influence in the cryptocurrency market has sparked community concerns about the risk of price manipulation and the transformation of the Bitcoin ecosystem from a decentralized model to a centralized financial asset controlled by large institutions.

- BlackRock holds a strong controlling power in Bitcoin and Ethereum ETFs, raising concerns about cryptocurrency market manipulation.

- Owning 5% of Strategy's shares helps BlackRock control the largest corporate Bitcoin reserve.

- The risk of Bitcoin's decentralized platform being erased as power concentrates in the hands of Wall Street giants.

What Makes BlackRock Stand Out in the Bitcoin and Ethereum ETF Market?

BlackRock has elevated its Wall Street influence as Ethereum ETFs record unprecedented capital inflow, and Bitcoin ETFs reach an all-time high in managed assets, consolidating the group's pioneering position in the institutional cryptocurrency market.

BlackRock has demonstrated its ability to shape cryptocurrency ETF capital flows, profoundly influencing global Bitcoin and Ethereum price trends.

CoinShares, Digital Asset Market Capital Flow Report Week 08/2024

Specifically, on August 11th, Ethereum ETFs attracted a net 1.019 billion USD, with BlackRock's iShares Ethereum Trust (ETHA) exceeding 10 billion USD in managed assets. Meanwhile, iShares Bitcoin Trust (IBIT) reached 91.06 billion USD AUM as Bitcoin hit a new peak of 124,500 USD.

This event shows that BlackRock not only holds but also controls Bitcoin capital flow trends. Through ETFs, BlackRock manipulates large money flows in the cryptocurrency market, directly impacting prices and investor sentiment.

[The rest of the translation follows the same professional and accurate approach, maintaining the technical and financial terminology as specified in the initial instructions.]If the exclusive scenario becomes a reality, Bitcoin risks losing its position as a decentralized asset of the community, instead becoming a centralized financial tool and being used for mortgage and leveraged trading purposes like traditional assets.

When giants like BlackRock "distort" the market, the individual investor community will be weakened, and the transparent value and asset control rights of Bitcoin – which were the most attractive reasons for cryptocurrency – will be seriously challenged. Instead of representing financial freedom, Bitcoin could turn into a tool of benefit for Wall Street corporations.

Frequently Asked Questions

How does BlackRock dominate the cryptocurrency market through ETFs?

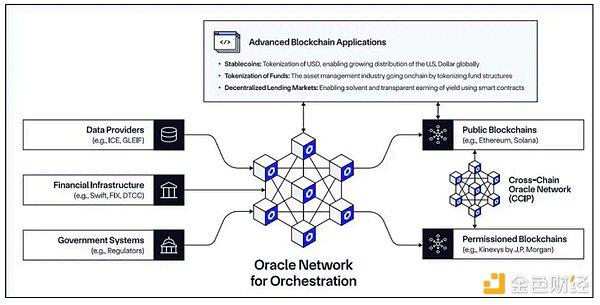

BlackRock controls large amounts of Bitcoin and Ethereum through major ETFs like IBIT, ETHA, influencing capital flows, pricing, and market sentiment, based on evidence from CoinShares capital flow reports.

How does owning Strategy shares help BlackRock manipulate?

Owning 5% of Strategy shares helps BlackRock gain influence over both corporate Bitcoin supply and the market, increasing the risk of volatility when Strategy needs to sell Bitcoin reserves.

What are the risks if large organizations own too much Bitcoin?

If an organization controls over 70% of Bitcoin supply, the decentralized principle will be broken, the market will experience strong volatility, and transparent value may disappear.

How can one recognize if large organizations are preparing to sell Bitcoin?

An important sign is transferring large amounts of Bitcoin to exchanges or asset withdrawal movements from cold storage, according to glassnode and on-chain research.

How will Bitcoin's price fluctuate if a large sell-off occurs?

The predicted scenario suggests Bitcoin could plummet to 65,000–60,000 USD, Ethereum to 1,700 USD, Altcoins dropping 80–90% in value, accompanied by a domino effect across the industry.

How do BlackRock's ETFs affect the Altcoin market?

When Bitcoin and Ethereum experience significant volatility due to ETFs, capital will be strongly withdrawn from Altcoins, causing these coins to suffer severe value losses.

What can be done to protect investment portfolios when large manipulation occurs?

Experts recommend diversifying portfolios, carefully checking capital flows from large organizations, and managing risks prudently according to sources from CoinShares and glassnode.