The encrypted asset market has quietly reached a new milestone, with Assets Under Management (AUM) soaring to an all-time high.

This increase shows that Ethereum's infrastructure is increasingly becoming the preferred payment layer for stablecoins and enterprise-level encryption.

Tokenization Reaches Historic Scale

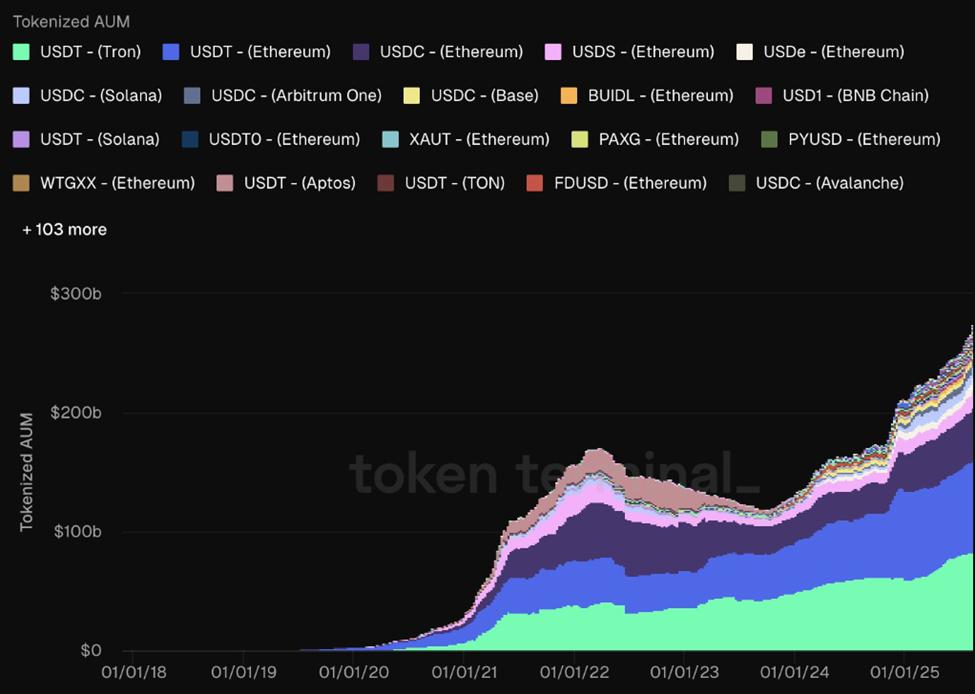

Token Terminal reports that the AUM of encrypted assets is at an all-time high, around $270 billion.

Tokenized Assets AuM. Source: Token Terminal

Tokenized Assets AuM. Source: Token TerminalThe on-chain data platform emphasizes that encrypted assets span across various fields, from currency and commodities to treasury, private credit, private equity, and venture capital.

Most of this growth is driven by organizations adopting blockchain to increase efficiency and accessibility, with Ethereum emerging as the dominant platform.

Ethereum accounts for about 55% of the total AUM of encrypted assets, thanks to its smart contract ecosystem and widely adopted token standards.

Tokens like USDT (Ethereum), USDC (Ethereum), and BlackRock's BUIDL fund represent some of the largest value sources, built on the ERC-20 framework.

Meanwhile, specialized standards like ERC-3643 allow for tokenizing real-world assets (RWA) such as real estate and high-end art.

With $270 billion already tokenized, the development momentum could potentially increase the encrypted asset market to trillions of dollars as Ethereum consolidates its role as the backbone of encrypted finance.

Financial Corporations Quietly Support Ethereum

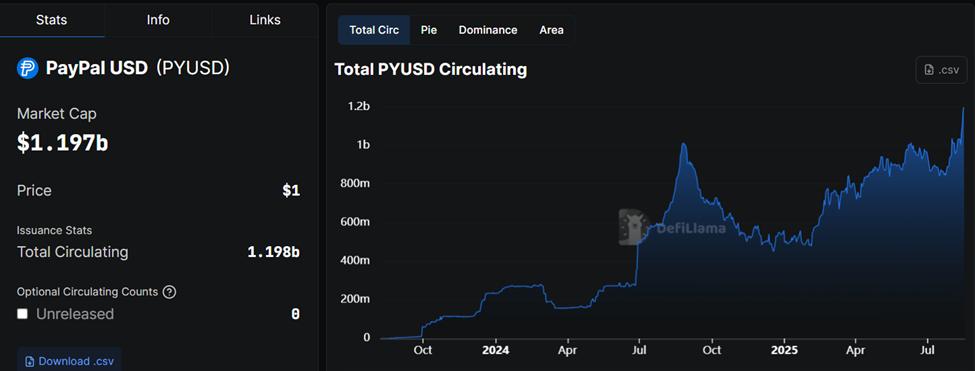

One of the clearest signs of this transformation is the growth of PayPal's PYUSD stablecoin, which has exceeded $1 billion in supply and is entirely issued on Ethereum.

PYUSD Supply. Source: DefiLlama

PYUSD Supply. Source: DefiLlamaFor organizations, PYUSD's rapid development proves that Ethereum's platform is sufficiently liquid, safe, and reliable for a global fintech company to scale up.

"PayPal's PYUSD exceeding $1 billion in supply reinforces Ethereum as the payment layer for major finance. Such stablecoin scale deepens liquidity and utility. Organizations are quietly standardizing on ETH," a user commented in a post.

Not just PayPal, traditional asset managers are also turning to Ethereum. BlackRock's crypto money market fund, BUIDL, has been cited as a typical case of institutional acceptance. This shows how traditional financial tools (TradFi) can be issued and managed seamlessly on-chain.

Meanwhile, Ethereum's dominance in crypto comes from its network effect and developer ecosystem. The ERC-20 standard has become the common language for digital assets, ensuring compatibility across wallets, exchanges, and DeFi protocols.

Ethereum's improvements in security, liquidity, and scalability through upgrades like Proof-of-Stake (PoS) and rollups increase institutional trust.

Ethereum's flexibility allows it to serve both retail and institutional investors' needs. Stablecoins like USDT and USDC drive global payments and DeFi liquidity. Meanwhile, encrypted treasury and credit tools directly attract institutional investment portfolios seeking profitability and efficiency.

However, analysts caution Ethereum traders, with the largest altcoin by market capitalization facing a second major sell-off wave. Similarly, warning signals are flashing despite 98% of Ethereum supply being in a profitable state.