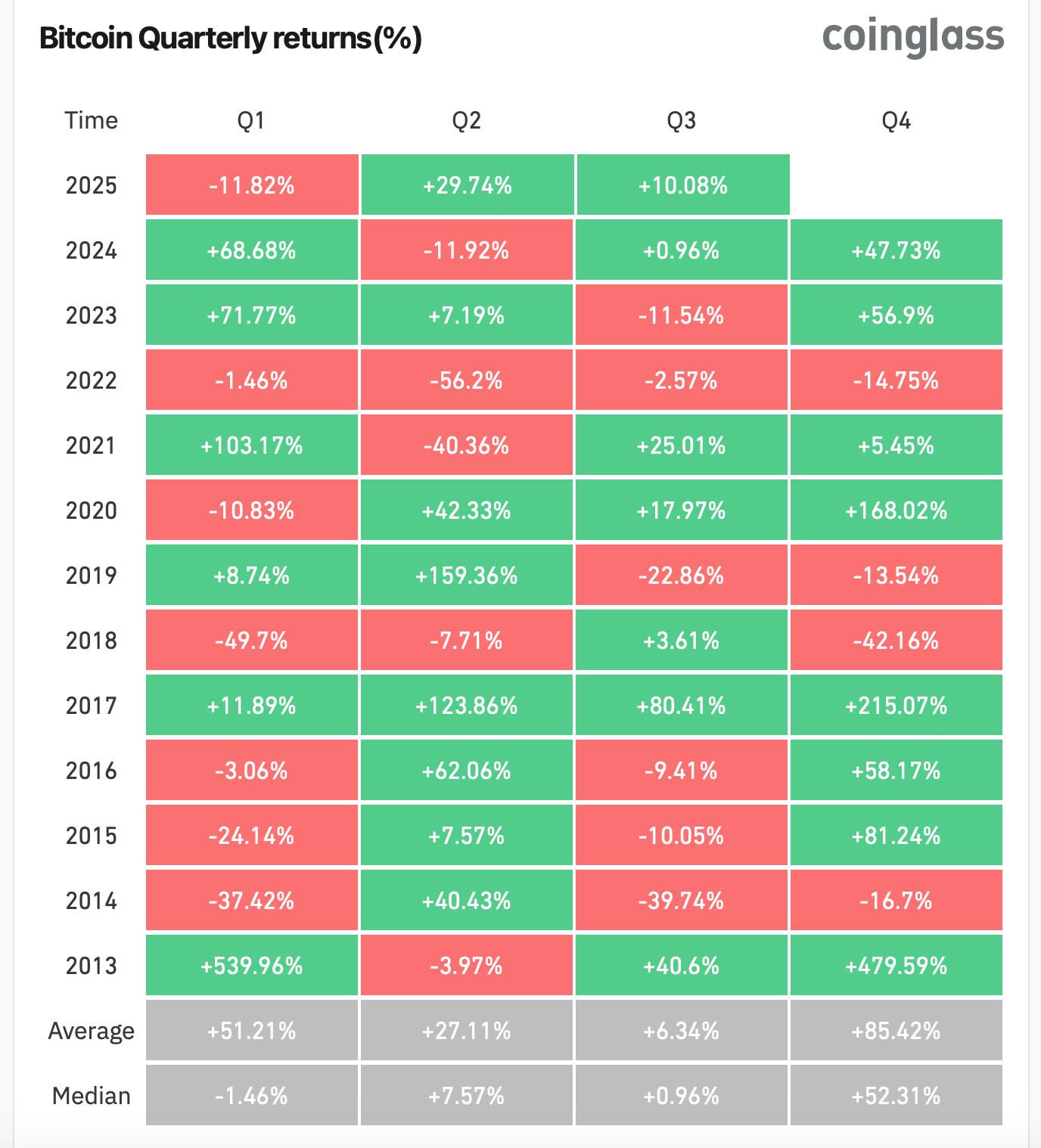

Historical data shows Bitcoin increases by an average of 85% in Q4, with positive profits in 8/12 recent years, suggesting a positive outlook for the end of 2025.

The Bitcoin market is entering a crucial stage as investors focus on the fourth quarter of 2025. Analysis of data from coinglass.com shows Bitcoin experienced mixed movements in the first 8 months of the year, but historical seasonal trends indicate strong growth potential in the final months.

In 2025 so far, Bitcoin has gone through a clear chain of fluctuations with January increasing by 9.29%, followed by a significant drop of 17.39% in February. Subsequently, March continued to decline by 2.3% before strongly recovering with a 14.08% increase in April and 10.99% in May. Q2 ended positively with June rising an additional 2.49%. Entering Q3, Bitcoin maintained its upward momentum with July increasing by 8.13% and August rising 1.83% as of the 17th.

Currently, Q3/2025 records an increase of over 10% with the first two months being positive, while September is not yet complete. Historical data shows Q3 typically experiences significant volatility, with a loss rate of 6/12 past years, but the Medium profit remains slightly positive at 0.96%. If September follows historical trends with half the years being negative, Bitcoin could end Q3 with a modest increase.

Q4 – Primary Momentum in Growth Cycle

The key focus is on Q4, especially during Bull runs. Statistics show Bitcoin ends Q4 in the green in 8/12 recent years, with particularly outstanding years like 2017 increasing 215%, 2020 rising 168%, and 2013 surging 479%. Even in less favorable years, Q4 profits typically outperform previous quarters.

On average, Q4 records an 85% increase with a Medium profit of 52.31%, confirming its position as Bitcoin's strongest period of the year. Monthly trends also reinforce this outlook, with November and December being two of the best historical months. November averages a 46% increase and provides positive profits in 10/12 years, including strong rallies in 2020 and 2021. December maintains an average increase of 4.7%, creating a solid foundation for a positive year-end.

Although past performance does not guarantee future results, historical data suggests Bitcoin's current accumulation phase could pave the way for a strong Q4. With August and September still ongoing, the final result of Q3 is not yet fully shaped, but seasonal trends lean towards the possibility that the year-end months will continue to push Bitcoin prices higher, consistent with the historically verified market cycle pattern.