Welcome to Asia Pacific Morning Brief—an important summary of overnight cryptocurrency developments shaping regional markets and global sentiment. Monday's edition is a summary of last week and a forecast for this week, brought to you by Paul Kim. Enjoy a cup of green tea and follow this space.

Bitcoin dropped below $117,000 after reaching a new All-Time-High above $124,000, as hot inflation data reduced expectations of Federal Reserve rate cuts. The market now only expects two rate cuts this year instead of three.

Fed Rate Cut Hopes Are Fading

The cryptocurrency market experienced significant volatility last week, as unstable macroeconomic indicators reduced expectations of strong Federal Reserve rate cuts. After rising to a new All-Time-High above $124,000, Bitcoin's price declined, at times dropping below $117,000.

This sentiment decline followed a series of hotter-than-expected inflation reports, raising doubts about continued monetary easing from the US central bank.

The most important economic report last week was released on Tuesday with the publication of the July CPI. The market reacted positively because the headline CPI was lower than Wall Street's expectations. However, upon closer examination, the situation was not as good.

Tariff Costs Finally Impacted Consumer Prices

CPI report details showed a significant increase in both Core CPI (excluding food and energy) and "Supercore" CPI (measuring service inflation excluding housing). The strong increase in Supercore CPI since April, in particular, indicates rapidly increasing service sector inflation.

An even bigger shock came on Thursday with the release of July's Producer Price Index (PPI), measuring wholesale inflation. PPI unexpectedly increased 0.9% month-on-month, a record increase and the first in three years. This was surprising, as production prices had remained relatively stable in May and June, even as the US "trade war" escalated.

Trade experts explained this increase as a delayed response to US tariff policies. While companies initially seemed to absorb costs by building inventory, July data showed they could no longer withstand financial pressure. The signal is that businesses are now transferring tariff-related costs to the next production phase, with service inflation again being the primary driver. Particularly, price increases in the service sector were also prominent in the PPI.

Perhaps the most concerning indicator for the market was July's US Import Price Index. According to conventional economic theory, tariffs typically drive import prices higher. The Trump administration cited the fading effects of May-June to argue that their trade policy avoided inflation.

However, the strong increase in import prices in July showed a critical turning point. This implies that import and export companies, which had absorbed tariff costs, are now passing them on to consumers.

The Federal Reserve has expressed significant concern about tariff inflation potential in its two most recent Federal Open Market Committee (FOMC) meetings. If import prices continue rising in August due to trade policy, additional Fed rate cuts may become increasingly difficult to justify.

Rate Cut Expectations Reduced from Three to Two

The changing macroeconomic landscape directly affects Bitcoin's price and market performance. The changing macroeconomic landscape directly affects Bitcoin's price and market performance.

This correlation was clearly demonstrated on Thursday when Bitcoin's price surged past $124,000 after Treasury Secretary Scott Bessent mentioned the possibility of a 50 basis point rate cut in a media interview in September. The PPI report immediately erased previous market gains. Bessent retracted his comments and recommended a more cautious 25 basis point rate cut.

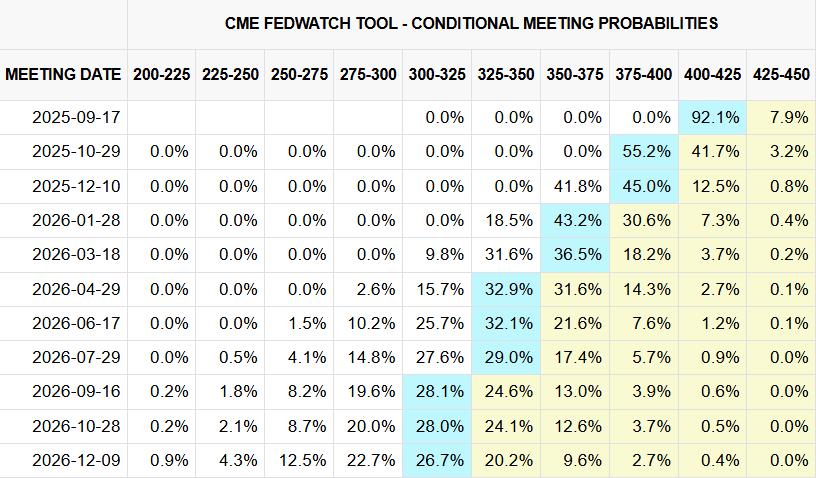

Market expectations were readjusted. According to the CME FedWatch Tool, as of Friday, investors now only price in two rate cuts for the remainder of the year, reduced from three. Flow data also showed a significant shift in investor sentiment.

CME Group FedWatch rate forecast (as of 18/08/2025). Source: FedWatch

CME Group FedWatch rate forecast (as of 18/08/2025). Source: FedWatchOn Friday, around the time of the import price index release, there was a sudden surge in Bitcoin deposits to Binance. This sudden increase is typically considered a sell-off signal. After recording net inflows throughout the week, Bitcoin and Ethereum spot ETFs experienced net outflows.

Altcoins were not immune either. Last week, the world's second-largest cryptocurrency, Ethereum, reached its All-Time-High on Monday. However, it could not surpass its All-Time-High in USD ($4,860) throughout the week. At 00:00 UTC on Monday, Ethereum was trading around $4,460.

All Eyes on Jackson Hole Awaiting Powell's Next 'Hint'

What seemed almost certain just last week—three Fed rate cuts this year—is now uncertain.

July's deteriorating US employment data created a strong reason for easing, but the resurgence of inflation has caused the Fed to reconsider. The decision now lies in Federal Reserve Chair Jerome Powell's hands.

The financial world will seek clues at the Federal Reserve's annual Jackson Hole Economic Symposium, taking place from August 21 to 23. This prestigious event, organized by the Federal Reserve Bank of Kansas City, brings together central bankers from around the world.

Chairman Powell will deliver a speech on US monetary policy at 02:00 UTC on Friday. He has previously addressed monetary policy changes at the Jackson Hole meeting. A famous example is when he hinted at a 50 basis point reduction in his speech last September.

Two prominent "doves" will also speak this week: Vice Chair Michelle Bowman (Wednesday) and Governor Christopher Waller (Thursday). Both previously supported early interest rate cuts, citing concerns about a slowing economy and weak labor market. Investors will closely monitor whether recent inflation data might alter their "dove" stance.

Several significant macroeconomic indicators will be released this week. However, the July FOMC meeting minutes, to be published on Wednesday, could significantly impact the market, depending on their content.

If other FOMC members also support interest rate cuts alongside Bowman and Waller, the market might revive rate cut expectations. This scenario could trigger another volatility wave in the Bitcoin market. We wish all readers a successful investment week.