Recent articles about Altcoins have been discussed extensively, so today let's chat from a different angle.

#Bitcoin has entered another oscillation period, with interest rate cuts approaching in September, and true FOMO may unfold at any moment. At the 4-hour level, focus on the 117,000 support; if it breaks, it may retest 112,000. Once lost, the short-term market could become tricky, so this point is crucial.

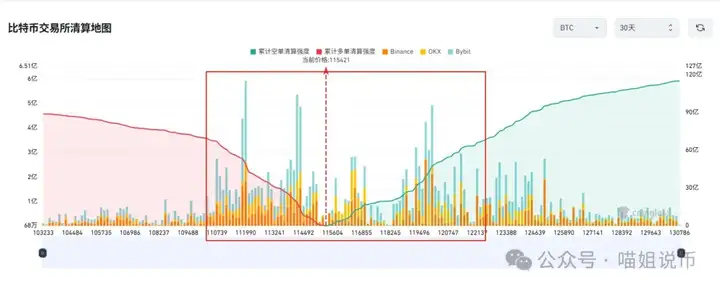

On-chain data remains stable, but position control is important. From the liquidation map, long and short chips are concentrated in the 110,000 to 120,000 range. If the main force suppresses it to around 110,000, it might complete a long liquidation.

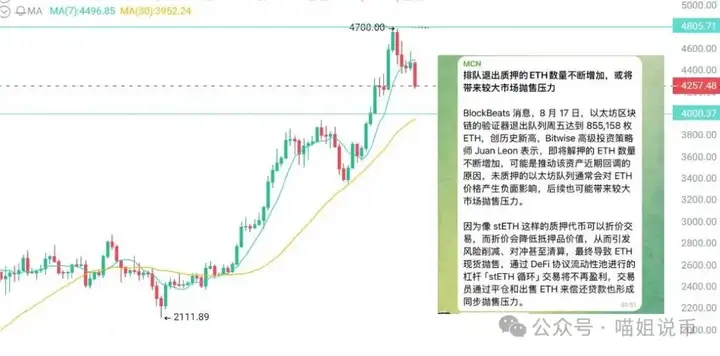

Many people are worried that ETH might fall below 4,000, but there's no need to panic. The lower support is solid, and the pullback looks more like a consolidation. #ETH's overall trend remains upward, with short selling volume decreasing, indicating this is not a major sell-off, but a healthy oscillation.

Exchange+Q: 3806326575

In a bull market, resistance levels are meant to be broken: rise for a while, pull back for a while, then rise again. Wait for the stop-loss signal to appear, and that's your entry opportunity; don't be swayed by emotions.

ETH Staking and Capital Flows

ETH withdrew 850,000 tokens from the staking queue this week, a historical high, which might bring short-term pullback pressure. Combined with staking derivative discounts and liquidity risks, this could trigger chain liquidations and selling pressure. Recent token unlocks for #FTN, #ZRO, #ZK also need attention.

On the other hand, L2 total locked value has risen to $45.19 billion (concentrated in ARB, BASE, OP, ZK), with RWA locked value breaking $13.41 billion, showing high capital concentration. If ETH can double-hit 4,700 and stabilize, Altcoins may have a chance to catch up.

Recommended Altcoin Analysis Reading:Widely Circulated! ETH Preparing, Next Target 6,600? These 4 ETH Ecosystem Potential Coins May Soar 30x

Market Warming? ETH Becomes Market Core Driver, Can DOGE, UNI, SOL Take Over? Did You Catch XDOG?

They Say the Bull Market Has Changed, So What's Different This Time?

Each Bitcoin bull market has new narratives and fresh blood, but one thing remains unchanged - retail investors' passion for technological freedom and financial freedom. But this time is a bit different: Google search interest is even lower than "Japanese-style walk" or "Labubu doll". Those previously enthusiastic - taxi drivers, distant relatives, kindergarten teachers... are almost completely silent.

The absence of retail investors isn't due to lack of awareness, but a different market environment: Bitcoin ETF launch, presidential-level attention, Larry Fink controlling the World Economic Forum... These events make many feel "this game isn't for me". Compared to the speculative experience of the last bull market, retail investors are clearly more cautious. Bitcoin has stabilized above $100,000 for 100 consecutive days, with the 200-day moving average breaking $100,000 - a strong signal for traders and long-term holders. After price and moving average both break historical resistance, a new round of rise could start at any time.

Meanwhile, this bull market is eliminating some long-term whales, making space for institutional funds. Retirement accounts are starting to include Bitcoin and crypto assets, meaning millions of Americans can legally accumulate "hard currency". But retail investors are still absent, making this bull market seem particularly "calm", also reminding us - opportunity lies in understanding market rhythm, not blindly following.

Summary:

Oscillation ≠ Peak, Pullback = Consolidation.

Hold the support, watch the funds, ETH and Altcoins still have potential. Don't disrupt the bull market rhythm, stabilize your chips to have a chance.

👉 Altcoin details will be in the next article to avoid excessive length.

Market waves come one after another, solo navigation is easy to get lost. To catch the next 2x opportunity, welcome to join my circle, watch the market, communicate, and buy the dips with old friends! Let's take fewer detours and outrun the next bull market! 📬V: c13298103401 💬Q:3806326575