Following the stablecoin issuer Circle and cryptocurrency exchange Bullish, the cryptocurrency exchange Gemini is also preparing to go public on the US stock market.

Gemini recently submitted its prospectus, preparing to list on the NASDAQ with the stock ticker "GEMI", with Goldman Sachs and Citigroup serving as lead underwriters.

Gemini stated that the proceeds from its IPO will be used for general corporate purposes and to repay all or part of third-party debt.

First Half-Year Revenue of $68.61 Million and Net Loss of $282 Million

Gemini was founded in 2014 by billionaire twin brothers Tyler Winklevoss and Cameron Winklevoss, who rose to fame by suing Facebook and its CEO Mark Zuckerberg for stealing their social network idea.

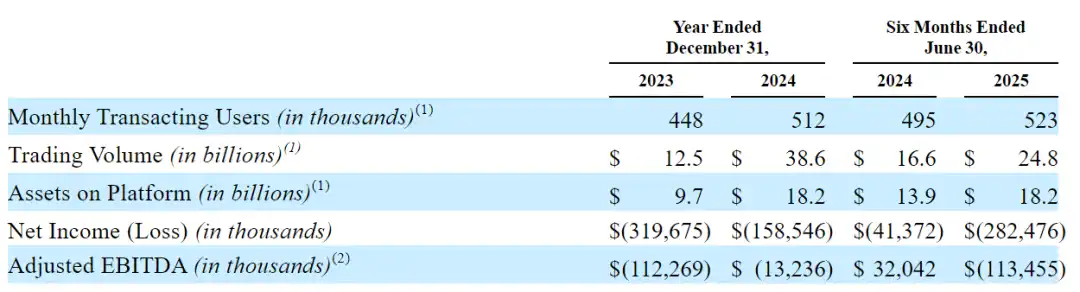

In 2008, they reached a settlement with cash and Facebook stock.

Gemini issues the Gemini Dollar (GUSD), a stablecoin pegged 1:1 to the US dollar. Gemini supports over 70 cryptocurrencies and operates in more than 60 countries/regions. As of June 30, 2025, Gemini served approximately 523,000 MTUs and about 10,000 institutions across 60+ countries, with platform assets exceeding $18 billion, cumulative trading volume over $285 billion, and transfer amounts processed over $80 billion.

Since its inception, as users explored the on-chain world, Gemini witnessed the overall market capitalization of cryptocurrencies grow from less than $10 billion to over $3 trillion.

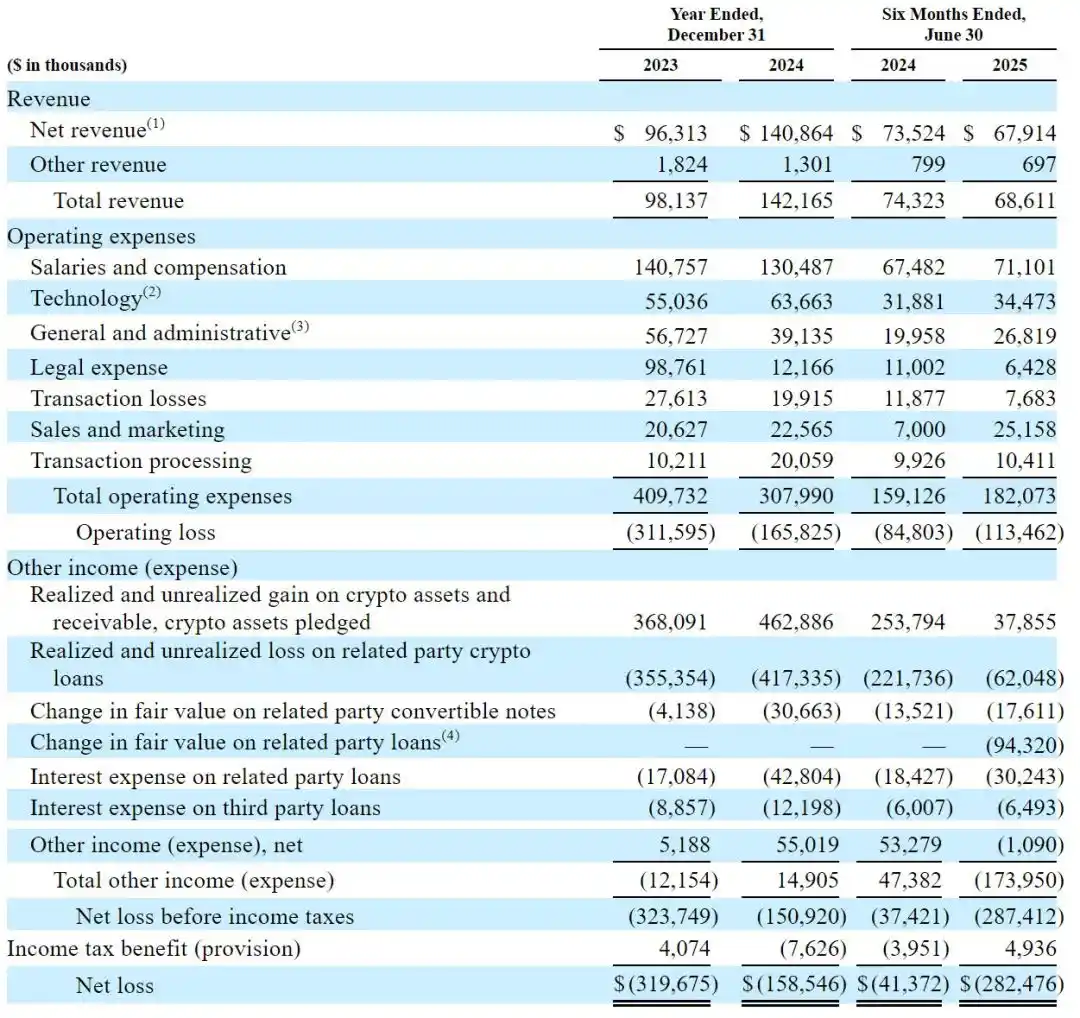

The prospectus shows that Gemini's revenue was $98.14 million and $142 million in 2023 and 2024, respectively; operating losses were $312 million and $166 million; net losses were $320 million and $159 million.

Gemini's revenue in the first half of 2025 was $68.61 million, a 7.6% decrease from $74.23 million in the same period last year; operating loss was $113 million, compared to $84.8 million in the previous year; net loss was $282 million, compared to $41.37 million in the same period last year.

Gemini's Adjusted EBITDA for the first half of 2025 was -$113 million, compared to $32.04 million in the same period last year.

Winklevoss Brothers Once Participated in the Olympics

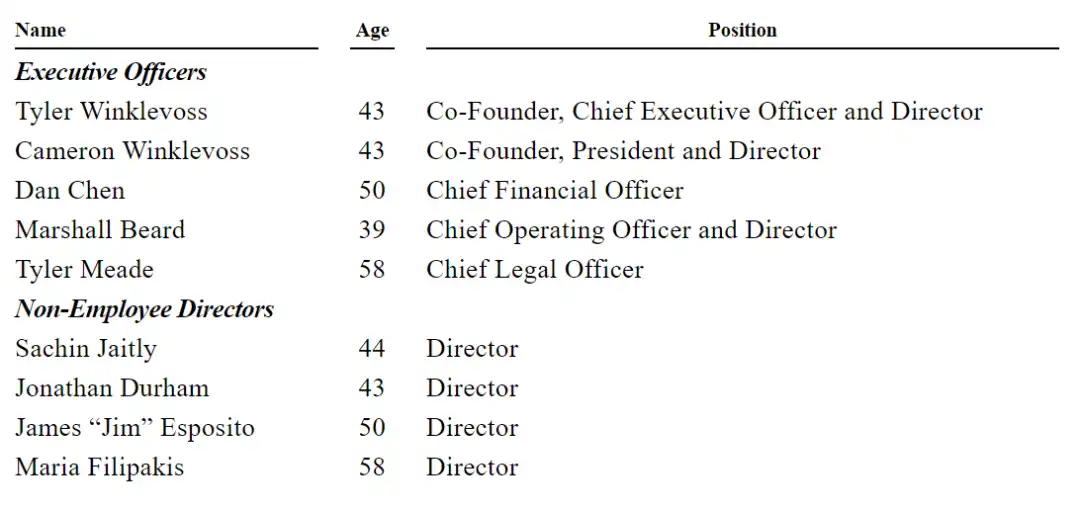

Gemini's co-founders are Tyler and Cameron Winklevoss, with Dan Chen as CFO.

Marshall Beard is the CTO, and Tyler Meade is the General Counsel.

Tyler and Cameron Winklevoss are the company's actual controllers. The brothers were inseparable, attending Harvard together and always attending classes, eating, and exercising together.

The brothers were always "bound" together, and people gradually referred to them as the Winklevoss brothers. Initially, they had an idea to design a social website for Harvard students called HarvardConnection, and even hired Facebook founder Mark Zuckerberg to help with programming. However, the brothers later fell out with Zuckerberg, accusing him of stealing their idea to create Facebook. In 2012, they received cash and stock compensation of $65 million, including $20 million in cash and the rest in stock.

In 2012, the Winklevoss brothers began accumulating Bit using part of the Facebook settlement, purchasing about 120,000 at a price of less than $10 each. They co-founded Gemini in 2014.

Not only are the Winklevoss brothers tech-savvy, but they are also athletic, participating in the men's pair rowing event at the 2008 Beijing Olympics and finishing sixth.

Circle and Bullish Successively Listed on US Stock Market

Bullish (ticker: BLSH), a cryptocurrency exchange operator supported by Silicon Valley investor and billionaire Peter Thiel, went public on the NYSE last week.

Bullish's issue price was $37, significantly higher than the previous range of $28 to $31. The issuance scale expanded to 30 million shares, raising a total of $1.11 billion.

Bullish's opening price was $90, up 143% from the issue price; it peaked at $118 intraday, up 219% from the issue price; and closed at $68, up 84% from the issue price. Based on the closing price, the company's market value was $9.94 billion. As of Friday's close, Bullish's market value was $10.2 billion.

Bullish's Chairman and CEO is Thomas W. Farley, who was previously the President of the NYSE. Bullish stated in its documents that it holds over $3 billion in liquid assets, including 24,000 Bit, 12,600 Ethereum, and over $418 million in cash and stablecoins.

Earlier, USDC stablecoin issuer Circle went public on the New York Stock Exchange, selling a total of 34 million shares and raising $1.054 billion in total; among which, Circle sold 14.8 million shares in this IPO, obtaining $459 million; existing shareholders, including the CEO, reduced 19.2 million shares, cashing out nearly $600 million.

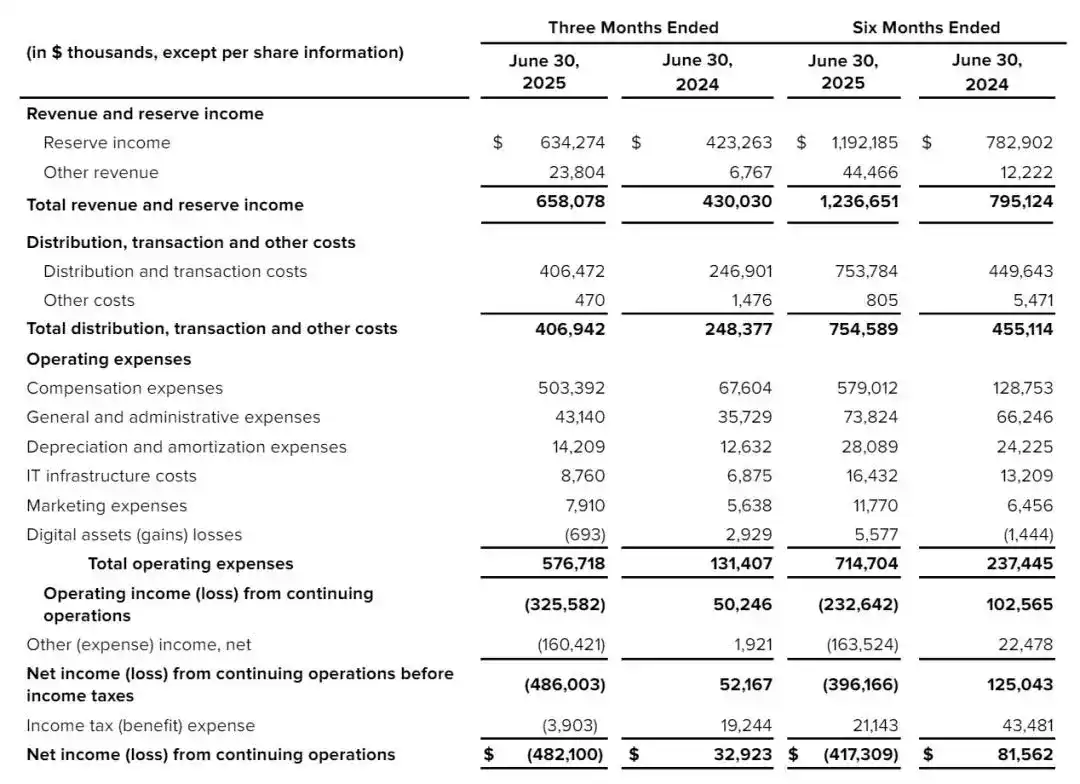

According to the financial report, Circle's total revenue and reserve income in the first half of 2025 was $1.237 billion, compared to $795 million in the same period last year; net loss was $417 million, compared to $8.156 billion in the same period last year.

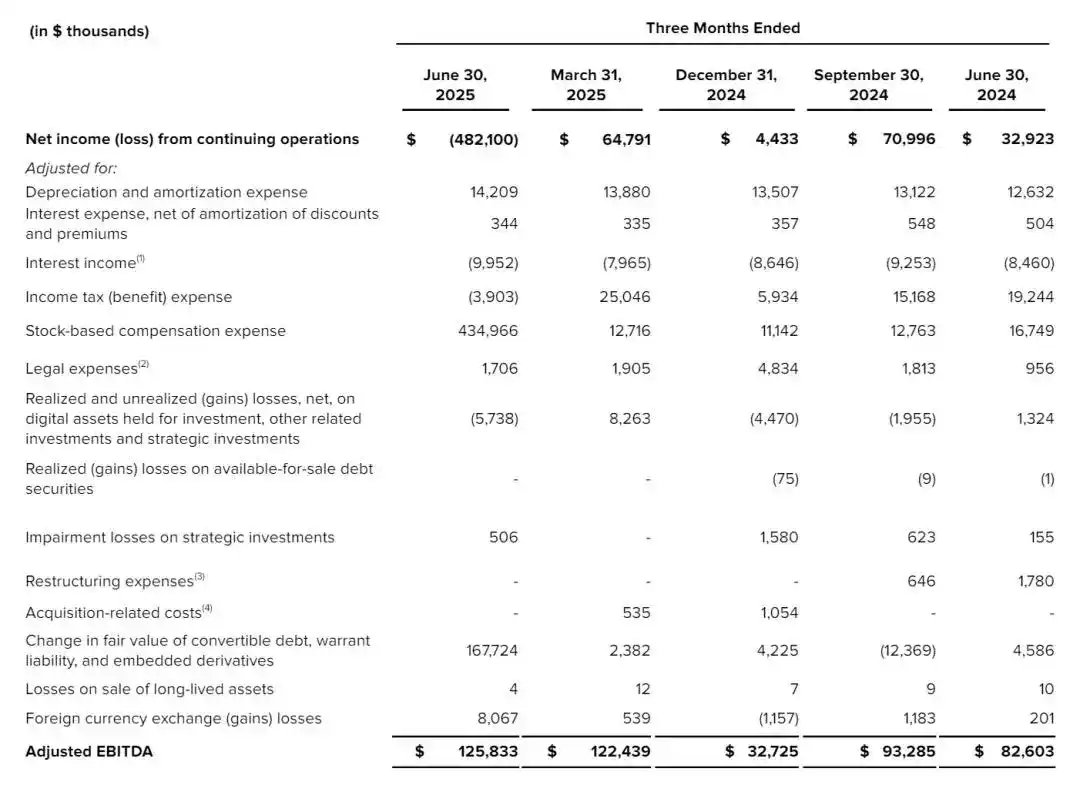

Circle's total revenue and reserve income in the second quarter of 2025 was $658 million, a 53% increase from $430 million in the same period last year.

Circle's net profit from continuing operations in the second quarter of 2025 was -$482 million, compared to $32.92 million in the same period last year. Circle's loss was mainly affected by massive IPO expenses. These expenses totaled $591 million: of which, $424 million was used for stock compensation related to the vesting conditions met by the IPO. Due to the stock price increase, the fair value of Circle's convertible bonds increased by $167 million.

Circle's Adjusted EBITDA in the second quarter of 2025 was $126 million, a 52% increase from $82.6 million in the same period last year; the Adjusted EBITDA rate was 40%.

As of June 30, 2025, USDC circulation increased by 90% year-on-year, reaching $61.3 billion; as of August 10, 2025, USDC circulation further grew by 6.4%, reaching $65.2 billion.