Written by: Luobo Finance

The market is so unpredictable. Bitcoin, which just reached a new high, didn't even have time to celebrate before dropping nearly $10,000 in 4 days, with a potential for further decline. The recently brightest star ETH is no exception, with its upward momentum abruptly cut off, falling from $4,788 to below $4,300. The more volatile altcoin market was once again "bled", with most tokens dropping over 15%, cooling down the restless altcoin sector.

The reasons for rising are often unclear, but there are always explanations for declines.

In fact, since the beginning of this year, the key factor determining market direction has been US monetary policy. This year, market expectations have been well reflected in the crypto market - when rate cut expectations rise, the market goes up; when expectations fall, the market drops. Against this background, whether, how much, and how to cut rates have become the most closely watched issues for market observers.

The discussion about rate cuts in the US can be described as a political drama.

The US, which has been in a tightening cycle for three years, has shown significant results. Regardless of external complaints, the fact is that inflation has gradually become controllable. Although Biden's direct cash handouts to improve household balance sheets challenged inflation, they effectively transferred debt from families to the government, helping the US achieve an economic soft landing.

However, the tightening cycle, originally expected to end soon, was disrupted by Trump's tariff war. The Federal Reserve found itself in a dilemma, balancing GDP contraction and high inflation while also needing to maintain flexibility to respond to potential presidential policies. A confrontational pattern between Trump and the Federal Reserve thus formed.

Trump, furious, posted multiple social media messages criticizing the Fed for cutting rates too late, threatening to remove Powell, and even attempting to plant his own people in the Federal Reserve. Powell, standing his ground, firmly responded that Trump is not qualified to fire him, emphasizing that CPI and inflation are the core determinants.

Since data is the core, Trump became focused on data. In August, he fired Labor Statistics Bureau director Erica McEntaffer, claiming official data was deliberately manipulated to favor Biden. Early that month, employment data showed only 73,000 new non-farm jobs in July, far below the expected 102,000, significantly increasing recession possibilities. On August 11, Trump nominated conservative economist Anthony to the position, unsurprisingly an opponent of Biden.

Changing data statistical leadership, nominating Federal Reserve board member Miran, and repeatedly calling for Powell's resignation all demonstrate Trump's urgency for rate cuts. This urgency is understandable, as for Trump, rate cuts are not just an economic issue but a political one. The tightening cycle affects stock market performance and the crypto market, and with tariff impacts, Trump urgently needs to boost confidence, increase support rates, and divert conflicts.

This turbulence indeed served a purpose. The once-unified Federal Reserve now shows signs of increasing division. Since July, Federal Reserve board members Christopher Waller and Michelle Bowman voted against maintaining unchanged rates, advocating for an immediate 25 basis point cut - the first such simultaneous dissent in over 30 years. Recently, San Francisco Fed President Mary Daly and Chicago Fed President Goolsbee both suggested against hasty rate cuts. These divisions actually reflect increasing rate cut possibilities. By August, with underwhelming employment data, investor rate cut expectations rose, with CME showing a 84.8% probability for September rate cuts - essentially a market consensus, though uncertainties remain.

Returning to the market, on August 14, influenced by pension benefits and rising rate cut expectations, Bitcoin successfully reached a historic high of $125,000, while ETH rose even more significantly under institutional buying, hitting $4,788. Given the seemingly confirmed rate cuts, why did the market subsequently decline?

The reason lies in expectations. Although September rate cut probability increased, annual cut frequency decreased from 3 to 2 due to July's unexpected PPI index, with cut magnitude dropping from 100BP to 50BP, or even a pessimistic 25BP - delivering a massive shock to investors. Notably, while US stocks showed more resilience, the crypto market proved more sensitive to risk information, displaying greater weakness.

This Friday, the Jackson Hole Central Bank Annual Conference will convene in Wyoming, where Fed Chair Powell will make crucial economic outlook statements. This conference is highly anticipated, as Powell has previously revealed significant information. Three years ago, he warned about inflation's painful fight, causing short-term yield spikes; last year, he hinted at rate reductions, causing two-year yield drops. In September, the Fed initiated a rate cut cycle with a 50 basis point first cut. Although market expectations for next month's cut remain, the current tense political environment makes future developments uncertain. Consequently, capital shows signs of risk aversion.

Beyond rate cuts, Treasury Secretary Scott Besent also dampened spirits. In March, to fulfill campaign promises, Trump issued an executive order listing BTC as a strategic reserve asset, primarily involving existing BTC and proposing budget-neutral additional purchases. Despite being budget-neutral, the market held expectations of sovereign wealth fund BTC market entry. Unfortunately, Besent recently told Fox Business News that the US government won't make new BTC purchases, instead using $1.5-2 billion of seized BTC to fill the reserve, originating from criminal or civil asset seizures or forfeitures.

This news deeply disappointed the crypto market, causing an immediate BTC price drop. Interestingly, within hours, Besent softened his stance on X platform, suggesting seized BTC could form strategic reserves and promising to explore "budget-neutral" paths for more BTC. Despite the quick attitude shift, market skepticism remains. Notably, his rapid reversal demonstrates the crypto market's significant political energy, capable of causing a 180-degree ministerial turnaround.

Moreover, this adjustment is also due to leverage washing. Before the new highs of Bitcoin and Ethereum, market FOMO continued to intensify, with rising sentiment prevailing. Even as funding rates increased, long leverages were significantly higher than short leverages in the market. The disparate long and short forces would bring a larger chain reaction, and if prices show a unilateral trend, the impact would continue to expand. On August 14, the market cleared over $1.02 billion in derivative positions, with long positions reaching $872 million, while short positions were only $145 million. The game between them is ongoing. According to Coinglass data, if Bitcoin breaks through $117,000, the cumulative short liquidation intensity of mainstream CEXs will reach $558 million. Conversely, if Bitcoin falls below $113,000, the cumulative long liquidation intensity of mainstream CEXs will reach $690 million.

Overall, the crypto market with limited upward momentum ultimately entered an adjustment interval after reaching new highs under these compounded factors. Currently, Bitcoin has fallen from its highest point of $124,400 to $114,700, a decline of 7.79%, while ETH has retreated from $4,788 to $4,234, sliding 11.57%.

Although returning to an adjustment interval, there's no need for excessive panic from a market perspective. In terms of trading, during Bitcoin's four consecutive days of decline, trading volume and turnover rate have not significantly increased, indicating strong seller reluctance to sell. From a price support perspective, according to @Phyrex_Ni's data, Bitcoin's price support has completed 6 jumps. Currently, the position at $117,000 exceeds 750,000 coins, with high positions solidifying Bitcoin's price foundation. Of course, high positions also mean high risks, but given the existing holder attributes, even if briefly breached, holders won't easily release their chips without a significant downward trend. From the external environment, whether the expected rate cuts, regulatory openness, or big players' increased holdings, all reflect the market's continued positive development.

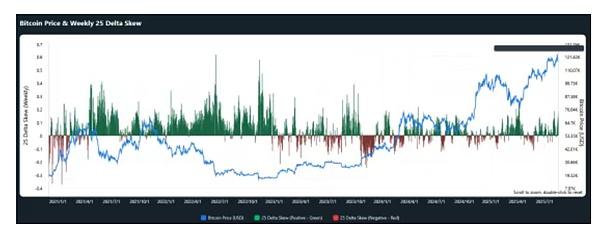

In fact, under an unchanged external environment, BTC's significant drop largely stems from market long-short divergence after reaching new highs. Bullish and bearish sentiments converge here, with emotional changes becoming particularly evident with slight fluctuations. From the options market alone, the current BTC 25 Delta Skew is nearly identical to the state in late March and early April, indicating the market indeed harbors certain bearish sentiment.

Compared to Bitcoin, Ethereum might face more significant issues. Although ETF data looks impressive, with Ethereum spot ETF experiencing a weekly net inflow of $2.85 billion last week, creating a historical high, from the staking queue perspective, ETH still faces considerable selling pressure. By the time of writing, Ethereum blockchain validators' exit queue reached 860,286 ETH, also a historical high, but the queue waiting to enter staking is only 290,541 ETH. This means investors waiting to profit and exit are increasing, and ETH might soon face substantial market selling pressure, which will intensify as ETH prices decline.

Rationally, given the central bank's annual conference this week, market direction will likely align with this timing. Currently, there are no clear negative news. While technically a correction trend objectively exists, and most technical analysts believe support is at $112,000, before Friday, under a relatively optimistic scenario, the market is unlikely to experience uncontrolled declines and will more likely remain in a oscillating state. ETH's price-bearing capacity is slightly weaker, and looking at the CME gap, the recent ETH CME gap is between $4,100-$4,200, with a certain probability of being filled or even further exploring downward.

Therefore, for ordinary investors, the old saying still holds: doing good hedging is the key.