- Technical indicators show short-term correction signals, but the long-term upward trend remains intact

- Asian institutions are accelerating BTC allocation, providing strong price support

- Analyst consensus target price of $135,000-$180,000, reflecting structural bull market expectations

BTC Price Prediction

BTC Technical Analysis: Short-term Correction but Long-term Trend Remains Bullish

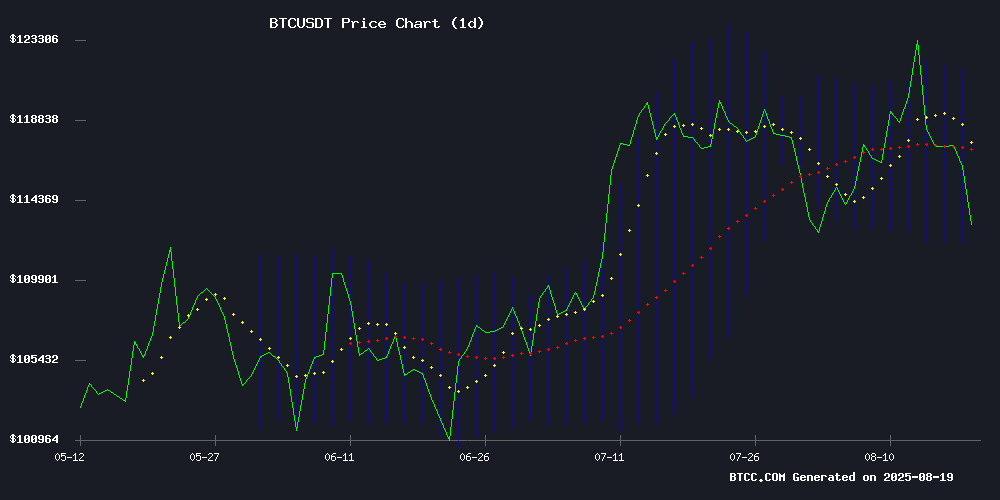

Based on the current BTC price of 115,883.46 USDT, slightly below the 20-day moving average of 116,727.85, indicating slightly weak short-term momentum. The MACD histogram shows a negative value (-1,079.68), but the signal line (-325.10) has started to converge, suggesting potential easing of selling pressure. The Bollinger Bands show the price near the middle band, with volatility within a normal range.

BTCC financial analyst James noted: 'Although technical indicators show short-term correction, the key support level of 111,835.14 remains unbroken, and the overall correction is still healthy. If it can bottom out in the 113,000-115,000 range, it will be favorable for bulls to launch a new offensive.'

Institutional Dip Buying Provides Strong Support for BTC

Institutions like Metaplanet continue to buy BTC on dips, with Japanese LibWork announcing a strategic allocation of $340,000. Thailand has launched its first national Bitcoin wallet, indicating accelerating adoption rates among Asian institutions.

BTCC financial analyst James analyzed: 'Despite profit-taking before Powell's speech, VanEck maintains its 2025 target price of $180,000, reflecting institutional confidence in the long-term trend. The current consolidation zone of 116,000-117,000 is an opportune moment for value investors to build positions.'

Key Factors Affecting BTC Price

Why Are Bitcoin Treasuries Becoming More Popular in Asia?

Bitcoin treasuries in Asia are experiencing rapid development, attracting investors, regulators, and corporate boards. According to K33 Research, the number of publicly BTC-holding companies increased from 70 to 134 between December 2024 and June 2025, more than doubling, showing the region's transformation from spectator to active participant. These companies currently hold 244,991 BTC, with eight Japanese companies leading the way.

This trend has caught the strategic interest of companies like American Bitcoin. This US mining company backed by the Trump family is seeking acquisition opportunities in Japan and Hong Kong to replicate MicroStrategy's treasury model. While this provides Asian markets with exposure to a new asset class, the lack of regulatory framework raises concerns about volatility and systemic risks.

The recent APEC Digital and AI Ministerial Meeting shows increasing institutional recognition of this trend, but how these treasury tools will withstand increasingly strict regulatory scrutiny remains unknown. This explosive growth—covering corporate balance sheets and professional investment tools—is now facing its first true stress test, with Asian markets exploring uncharted territory between innovation and stability.

Bitcoin Drops Below $116,000, Metaplanet Continues Dip Buying

Bitcoin retreated below $116,000 during Monday's trading session, significantly correcting from last week's historical high of $124,000. This correction reflects global market unease about US inflation concerns and Federal Reserve policy uncertainty.

Tokyo-listed Metaplanet operates counter-cyclically, purchasing 775 BTC at approximately $122,000 per coin, increasing its total Bitcoin treasury to 18,888 coins. This move demonstrates institutional confidence in Bitcoin's long-term value proposition, with reports indicating a 129.4% investment return for their Bitcoin strategy between April and June 2025.

Technical indicators suggest limited short-term holder selling pressure, with the Net Unrealized Profit/Loss (NUPL) ratio still far below historical profit-taking thresholds. Market participants are closely watching the $115,000 support level, which, if maintained, could pave the way for a rebound to $120,000.

Bitcoin's Sideways Movement Sparks Market Uncertainty, Analysts Predict $135,000 Target Price

Bitcoin's recent stagnant movement has raised questions among traders about its next significant move. The cryptocurrency's failure to maintain recent highs has left the market in a tense balance between support and resistance levels. Analyst opinions are divided—some view it as a typical consolidation phase, while others interpret it as a potential volatility precursor.

Market observer Daan Crypto Trades noted that directionless Bitcoin trading often signals significant breakouts. Historical patterns show August and September rarely rise simultaneously, with fourth-quarter explosive rallies typically accompanied by short-term corrections. Technical indicators remain unclear, though predictions suggest a potential 13% rise to $130,266 by mid-September.

The Fear and Greed Index currently stands at 60, reflecting growing investor risk appetite. In the past month, Bitcoin rose on 14 out of 30 trading days, maintaining average performance. This calm period is testing traders' patience, with the market awaiting a catalyst or capitulation event.

Bitcoin Bull Run Stalls, Long-term Holders Release Cautious Signals

After reaching a historical high of $124,000 last week, Bitcoin's rally has stalled, with prices dropping nearly 10% to $115,424. This correction has shifted market focus to on-chain data, particularly long-term holder behavior—historically a reliable market cycle indicator.

Crypto Quant data reveals a familiar pattern for veterans: the 2017 peak was accompanied by massive long-term holder profit-taking, while the 2018-2019 low period saw suppressive selling. The current RPL indicator seems reminiscent—experienced investors are again liquidating positions, though whether this signals a local top or a pause in the cycle remains debated.

Bitcoin Faces Profit-taking Pressure Before Powell's Jackson Hole Speech

Bitcoin Price Trend continues to be sluggish, with traders preparing for potential market volatility from Federal Reserve Chairman Powell's keynote speech at the Jackson Hole Economic Symposium. Cryptocurrencies dropped 1% on Monday, with QCP Capital describing it as a "de-risking" phase, and implied volatility indicators suggesting low expectations for short-term breakthroughs.

Market participants seem to be interpreting conflicting signals—last week's higher-than-expected PPI data cast a shadow on the Fed's policy path, while institutional funds continue to flow steadily. Notably, a trading company added 430 BTC (worth $51.4 million) this week, indicating a restrained but stable accumulation trend.

The annual Wyoming conference has historically been a policy turning point, with Powell's remarks often signaling monetary policy changes. This year's meeting is particularly important as traders seek clear signals about whether the Fed will pause or continue rate hikes in September.

VanEck Reaffirms Bitcoin $180,000 Target for 2025, Citing Institutional Momentum as Key Factor

Renowned crypto ETF issuer VanEck reconfirmed its optimistic Bitcoin year-end price prediction of $180,000. The company's August 2025 "ChainCheck" analysis report indicates that institutional fund inflows and on-chain profitability metrics are primary drivers, despite Ethereum presenting competition in capital attractiveness.

Corporate investment remains crucial to Bitcoin's resilience, with VanEck noting that 92% of holdings were profitable even before recent price increases. The report mentions: "Macroeconomic changes and seasonal trends may drive momentum or profit-taking," while maintaining confidence in Bitcoin's upward trend.

Japanese LibWork to Purchase $3.4 Million in Bitcoin for Hedging and Digital Strategy

Tokyo-listed LibWork (construction industry) announced plans to gradually purchase 500 million yen ($3.4 million) in Bitcoin before 2025, joining the wave of Asian enterprises adopting cryptocurrencies. This board-approved decision serves a dual purpose: hedging against Japanese yen depreciation and positioning for digital asset opportunities.

The company positioned Bitcoin as "digital gold" in its announcement, criticizing cash-heavy balance sheets' vulnerability to inflation. Acquisitions will be made gradually through off-exchange transactions, using quarterly mark-to-market accounting and immediate disclosure of significant impacts.

This funding strategy aligns with LibWork's Non-Fungible Token property plans—converting architectural designs into blockchain-based ownership certificates. These actions demonstrate traditional industries' active transition towards blockchain integration.

Bitcoin Consolidates Near $117,000, Institutional Adoption Continues to Rise

Bitcoin currently hovers around $117,000, with daily volatility less than 1%, showing low volatility. Its market cap remains stable at $2.32 trillion, with daily trading volume reaching $73 billion. Current price tests $116,000 support, with technical indicators suggesting potential breakthrough—a narrowing wedge pattern hints at imminent volatility, with 50-week SMA ($117,462) forming short-term resistance.

Institutional momentum continues strengthening: Dutch company Amdax prepares to list a Bitcoin reserve instrument on the Amsterdam Euronext, targeting 1% of BTC total supply. Michael Saylor's Micro Strategy further boosts market sentiment by acquiring 155 BTC, bringing its treasury reserves to 628,946 BTC (worth $74 billion). European corporate adoption accelerates, with 15 companies now including Bitcoin in their balance sheets.

Thailand Launches First State-Owned Bitcoin Wallet Targeting Tourism Market

Thailand takes a significant step in cryptocurrency application by launching its first state-owned Bitcoin wallet. The plan primarily targets tourists, aiming to simplify digital transaction processes and position Thailand as a forward-thinking, crypto-friendly travel destination.

This move reflects growing institutional interest in Bitcoin as a payment tool and store of value. By integrating cryptocurrency infrastructure at the government level, Thailand demonstrates confidence in blockchain technology's potential to reshape financial services.