A rate cut in September seems to be a high-probability event, and the biggest question now is: Will the market rise after the rate cut?

From historical experience, the answer is likely, but not an immediate rise upon rate cut.

VX: TZ7971

In market intuition, "rate cut" almost equates to a signal of liquidity release and asset price appreciation. However, looking back over the past thirty years, the Federal Reserve's rate cuts are far from simple. Sometimes they are preventive measures to ward off potential risks, and sometimes they are emergency relief measures during a crisis.

From 1990 to now, the Federal Reserve has experienced five major rate cut cycles, each with different economic backgrounds and policy motivations, and the stock market's reactions have been drastically different. To understand the relationship between rate cuts and the market, one cannot simply view it as a "bull market button", but must analyze it specifically in conjunction with the macroeconomic environment and investor sentiment at the time.

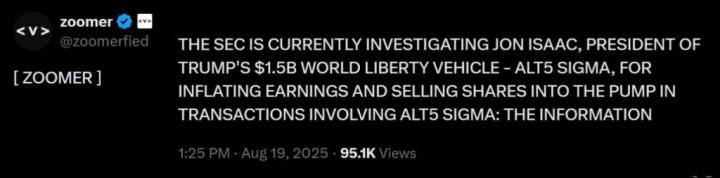

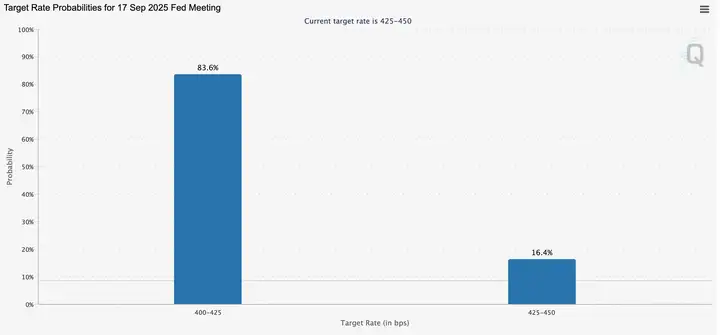

It has been a full year since the last rate cut, and the market is once again focusing on the September monetary policy meeting. According to FedWatch data, the probability of a 25 basis point rate cut by the Federal Reserve in September has reached 83.6%. Looking back over the past year, after the rate cut, not only did the S&P and Nasdaq hit new historical highs, but Bitcoin also saw a surge, which has once again sparked market expectations of the "rate cut = bull market" logic.

Current Insights: Preventive Easing and Altcoin Season

Looking back historically, the Federal Reserve's rate cuts can be divided into two categories: preventive rate cuts and relief rate cuts. Those in 1990, 1995, and 2019 belong to the former, with rate cuts occurring before a comprehensive economic recession, mostly to hedge risks and often injecting new growth momentum into the market; while in 2001 and 2008, rate cuts were forced under the pressure of financial crises, and the market subsequently experienced severe declines. In the current context, with a weak labor market, uncertainties from tariffs and geopolitics, but inflation showing signs of easing, the overall environment is closer to a "preventive rate cut" rather than a crisis background. It is precisely because of this that risk assets have continued to strengthen this year, with Bitcoin and US stocks both hitting historical highs.

The environment facing the crypto market is also different from before. For the first time, policy is bringing unprecedented positive signals: stablecoins are gradually being incorporated into compliance frameworks, digital asset treasuries (DAT) and treasury management represented by MicroStrategy are becoming corporate allocation trends, institutions are officially entering through ETFs, and the narrative of real-world asset (RWA) tokenization is also accelerating.

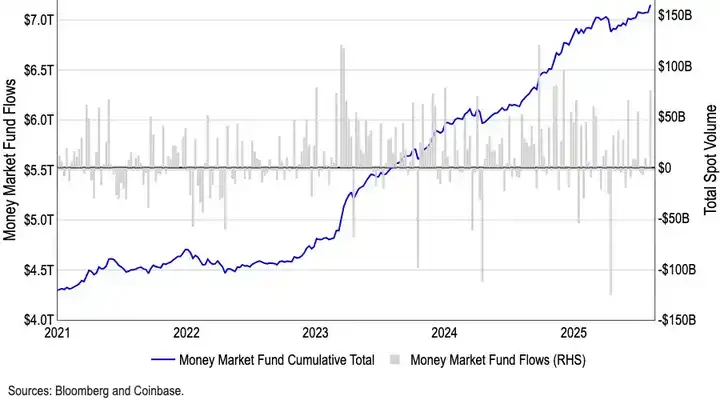

Although many argue whether the September rate cut will cause a short-term peak in the crypto market, from a capital flow perspective, such concerns may be exaggerated. The scale of US money market funds has reached a record $7.2 trillion, with a large amount of funds trapped in low-risk tools. Historically, outflows from money market funds often correlate positively with the rise of risk assets. As the rate cut lands, their yield attractiveness will gradually weaken, and more funds are expected to be released into crypto and other high-risk assets. It can be said that this unprecedented cash reserve is the most powerful potential powder keg for this bull market.

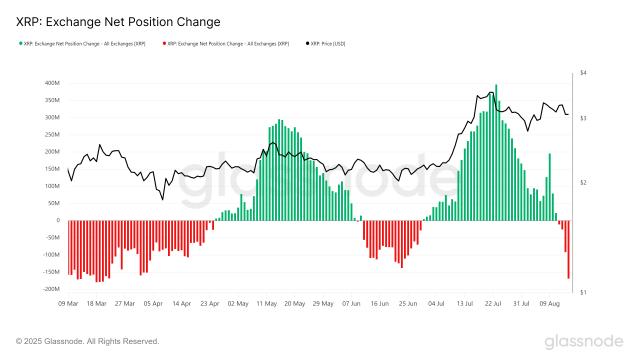

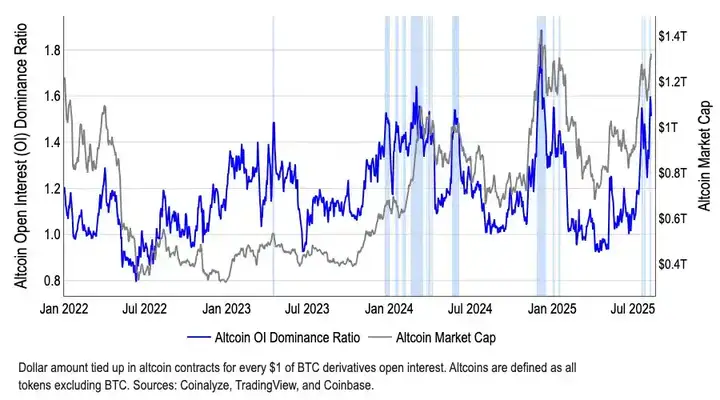

Moreover, structurally, funds have begun to gradually leave Bitcoin. BTC's market dominance has dropped from 65% in May to 59% in August. Meanwhile, the total market value of Altcoins has grown by over 50% since early July, reaching $1.4 trillion. Although CoinMarketCap's "Altcoin Season Index" is still around 40, far from the traditional definition of Altcoin season's 75 threshold, this deviation of "low indicator - soaring market value" precisely reveals that funds are selectively entering specific sectors, especially Ethereum (ETH). ETH not only benefits from institutional interest with ETF scale breaking through $22 billion but also carries the core narratives of stablecoins and RWA, possessing greater capital attraction than Bitcoin.

The logic of this bull market is completely different from the past. Due to the vast number of projects, it is no longer possible to reproduce the grand scene of "all coins rising". Investors' focus is gradually shifting towards value investment and structural opportunities - funds are more willing to flow to top projects with real cash flow, compliance prospects, or narrative advantages, while long-tail assets lacking fundamental support are destined to be marginalized.

At the same time, the overall market valuation is already high, and whether the treasury strategy risks being "over-financialized" remains unknown. If institutional or project-side concentrated selling occurs, it could easily trigger a stampede effect, causing a deep market impact. Additionally, with global macro uncertainties (such as tariffs and geopolitics), investors cannot ignore potential volatility.

Therefore, while being optimistic about crypto asset performance under the rate cut cycle and policy benefits, one must admit that this is more like a structural bull market, not an indiscriminate rise. Rational investment and carefully selecting tracks are of utmost importance.