Column: Block Rabbit Observation Institute

Column Introduction: Focus on the future and jump into the rabbit hole of new technology with you

Ethereum's core protocol is becoming increasingly powerful, but the ecosystem is facing unprecedented complexity.

Over the past year, Ethereum has staged a textbook engineering feat. From the Dencun upgrade, which fundamentally addressed Layer 2 cost issues, to the Pectra upgrade, which aimed to optimize the core staking economy, this "digital Leviathan" of the digital world has meticulously executed its public roadmap. However, a strange paradox confronts all observers: the certainty and success of the protocol layer seem to have not brought peace to the ecosystem, but instead spawned unprecedented complexity and potential risks. Ethereum's engine room (the main protocol) has never been stronger or clearer, but its vast new world (the Layer 2 and Restaking ecosystems) is filled with a clamor of opportunity and a fog of confusion. This begs a new question: With the war over the underlying protocols largely over, where will Ethereum's next battleground lie?

Duet of Dencun and Pectra

To understand Ethereum's current state, one must first acknowledge the tremendous success of its core engineering.

This victory was made possible by two key upgrades:

First, there's the economic transformation triggered by the Dencun upgrade in early 2024. By introducing Proto-Danksharding (EIP-4844), the Ethereum mainnet opens dedicated, inexpensive data channels (Blobs) for the Layer 2 network. This isn't just a minor fix; it's a fundamental cost revolution. Over the past year and a half, we've witnessed a sharp drop in Layer 2 transaction fees, which have remained at exceptionally low levels for a long time. The market has cast its most honest vote with its capital: while ETH's price has stabilized in recent months, it has significantly underperformed leading Layer 2 ecosystem tokens. This clearly demonstrates that expectations for value growth have successfully shifted from the mainnet's execution capabilities to the booming Layer 2 applications fueled by cheap data. Ethereum has successfully transformed itself from a "congested world computer" to a "secure settlement and data anchor" for the entire ecosystem.

The second is the governance evolution brought about by the Pectra upgrade completed in May this year.

If Dencun addresses the cost issue, Pectra directly addresses the control challenge. Facing the trend of validator power concentration under the PoS mechanism, Pectra, through improvements such as increasing the validator effective balance limit (EIP-7251), reduces the operational advantages of large staking pools and optimizes the decentralized staking experience. This is a precise, surgical intervention aimed at alleviating centralization pressures at the protocol level. While a single upgrade cannot eradicate all issues, it sends a strong signal to the entire community: Ethereum core developers have the ability and willingness to safeguard the decentralized nature of the network.

The successful delivery of these two upgrades means that the main contradictions at the Ethereum protocol level have been basically resolved. The engine room is running smoothly, providing an unprecedented deterministic foundation for the expansion of the superstructure.

Systemic Risks of Restaking and the Fragmentation of L2

However, the success of the engine room has pushed complexity to a wider ecological layer, giving rise to two major mysteries:

First, there's the maturity of the restaking sector and the inherent systemic risks. Restaking protocols, represented by EigenLayer, have evolved over the past year from a nascent concept into a vast, complex financial LEGO system. By sharing Ethereum's economic security, they provide the foundation for a host of emerging protocols (such as the DA layer, oracles, and bridges), undoubtedly a significant innovation. However, their essence is to add a new layer of leverage and risk, independent of the main protocol, to Ethereum's creditworthiness. A failure in a restaking service could trigger a forfeiture of ETH principal, leading to a series of cascading liquidations. This "potential systemic risk" has become a core concern for analysts assessing Ethereum's long-term stability.

Secondly, the booming L2 ecosystem has brought a side effect: severe fragmentation. Dozens of independent Rollup networks operate independently, creating isolated islands of liquidity and a disconnected user experience. Transferring user assets between different L2s is not only cumbersome but also faces security risks associated with different cross-chain bridges. This intensifying "L2 war," while spurring innovation, has also significantly harmed the overall effectiveness of the network. A supposedly unified digital nation has, in reality, splintered into countless city-states with separate languages and unconnected transportation.

What these two issues have in common is that neither can be solved simply by the next upgrade to ethereum’s main protocol. The battlefield has shifted.

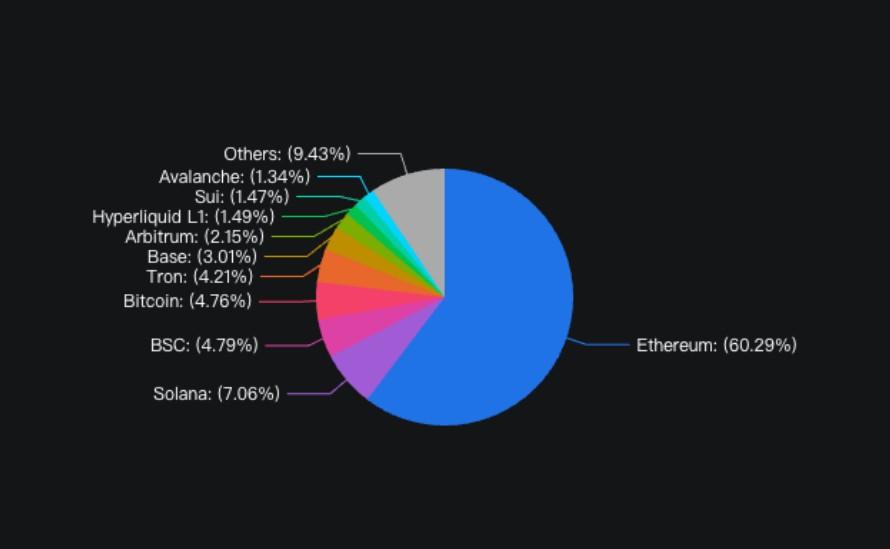

Image Caption: Layer 2 Total Value Locked (TVL) Market Share Pie Chart

Data source: defillama

Active Gardeners: How EcoDev is Bridging Ecological Rifts

Faced with an ecosystem in turmoil beyond the protocol layer's direct intervention, the Ethereum Foundation's response demonstrates mature governance that transcends purely technical thinking. Its Ecosystem Development Program (EcoDev) is playing the role of "active gardener," using "soft power" to bridge ecological gaps.

A review of its recent funding strategy reveals that EcoDev's investments are highly targeted. Rather than simply rewarding the most successful projects, it allocates significant resources to areas that can enhance the "public goods" of the entire ecosystem:

- Funding Standardization Tools: Supporting the development of common L2 cross-chain communication standards and developer toolkits to reduce the negative impact of fragmentation.

- Support academic research: Provide long-term funding for cutting-edge fields such as ZK technology and MEV mitigation solutions to ensure technological reserves.

- Cultivate a global community: Invest resources in emerging markets such as Asia, Africa, and Latin America to ensure that Ethereum’s culture and developer base remain global and diverse.

The core idea of this strategy is: since it's impossible to force uniformity through protocol rules, fostering public infrastructure and common standards can guide the ecosystem toward spontaneous convergence. This is a more flexible and long-term governance philosophy.

Evolution from protocol engineer to ecological gardener

Ethereum's future path is clear. It has successfully modernized its core protocol, building a robust and efficient underlying infrastructure. Now, its focus is shifting from being a "protocol engineer" to a more decentralized "ecosystem gardener."

This is a long march on two parallel tracks: at the protocol layer, we continuously carry out refined optimization and security reinforcement; at the ecosystem layer, we respond to new challenges arising from success through strategic investment and cultivation. What we see is no longer a development team solely focused on technical implementation, but a mature organization that understands how to govern a large, complex, and dynamic digital economy.

This ability to master complexity, face new problems calmly, and respond with diversified means is Ethereum's most trustworthy asset.