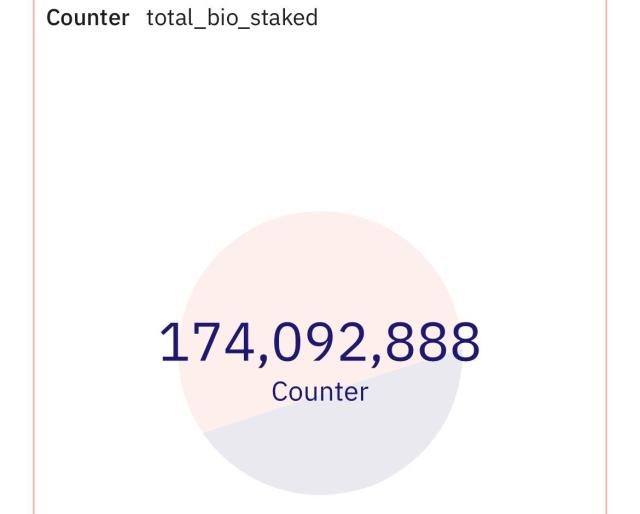

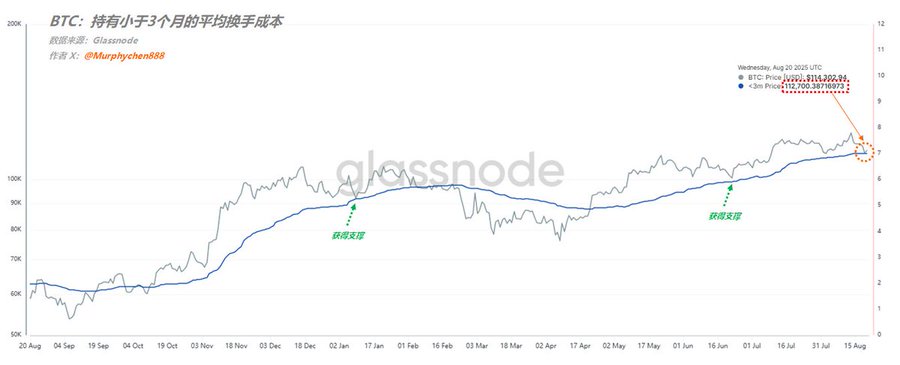

In our August 18th post (see quote), we analyzed that $112,000 is one of the key levels for BTC in this cycle. It's not just a marker for the validity of the URPD dual-anchor structure, but also the average cost basis for short-term holders (<3 months). If BTC breaks below this level, it could trigger much deeper bearish sentiment in the market. (Figure 1) Right now, we’re seeing that BTC found some temporary support right at the blue line yesterday (Figure 1), which is a positive sign. It means most short-term holders aren’t willing to sell at breakeven, so the selling pressure is relatively lighter—this can be seen as the current emotional floor. (Figure 2) But I say “temporary” support because realized losses yesterday still hit $87 million (Figure 2). While that’s lower than the $112 million we saw on 8/18, it’s higher than the $70 million on 8/19. Ideally, we’d like to see realized losses decrease even as price drops, but right now, it just looks like market sentiment is slowly easing up—not a clear reversal signal yet. So for the next few days, keep a close eye on the $112,000 support. As long as it holds, the trend is still intact. Personally, I’m still cautiously optimistic. 👇 👇 ‼️ This is just my personal sharing for learning and discussion, not investment advice. ‼️ ------------------------------------------------- Post sponsored by #Bitget | @Bitget_zh

This article is machine translated

Show original

Murphy

@Murphychen888

08-18

我们说$117,000是一个重要的支撑位,因为这里有大量的筹码换手,也就是多空双方争夺的焦点。跌破,意味着在短期内市场中的卖方占据了优势。 x.com/Murphychen888/…

Sector:

Signal Square

Channel.SubscribedNum 42000

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share